Investors urge Zara owner Inditex to emulate peers like H&M and Primark in unveiling their full supplier list to enhance the assessment of supply chain risks. The demand for transparency stems from Inditex's anomaly among major apparel retailers for not disclosing its factory sources.

Industry Pressure and Regulatory Demands

MSN noted that within the clothing sector, companies face mounting pressure to verify fair labor practices and wage standards within their supply chains. The spotlight on supply chain ethics has intensified, with Chinese fashion giant Shein encountering scrutiny from U.S. lawmakers as it plans a U.S. listing.

In the European Union, proposed regulations mandating environmental and labor impact disclosures have hit roadblocks. The potential sanctions for non-compliance, including fines up to 5% of revenue, underscore the growing emphasis on corporate responsibility.

Leading Brands Set the Transparency Bar

Fashion powerhouses like Adidas, Nike, and H&M have taken proactive steps by publishing detailed supplier lists and providing visibility into factory details. Meanwhile, Inditex discloses the number of suppliers by country annually but refrains from divulging specific factory information.

Shareholder Advocacy for Disclosure

Reuters reported that Dutch asset manager MN, representing institutional investors with significant assets, spearheads the call for enhanced disclosure from Inditex. The dialogue aims to push for supplier transparency to assess the company's information availability and due diligence practices.

MN, managing Dutch pension fund assets, underscores the significance of supplier insights in evaluating Inditex's data accessibility and operational transparency. The group leads the Inditex dialogue within the Platform Living Wage Financials initiative.

Inditex's ownership landscape, dominated by founder Amancio Ortega and daughter Sandra Ortega, reveals a substantial family stake. The investors engaging with Inditex collectively hold a significant share in the company, emphasizing the need for accountability and transparency.

Financial Influence and Market Valuation

The investors interacting with Inditex command a substantial financial footprint, adding weight to their calls for improved disclosure. Inditex's current market valuation underscores the significance of addressing investor concerns regarding transparency and supply chain ethics.

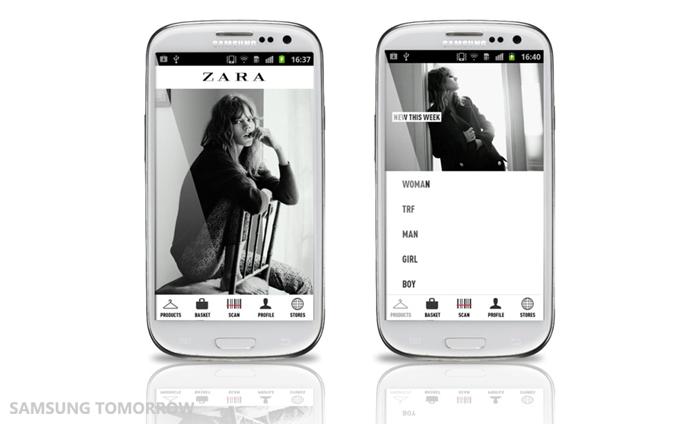

Photo: Samsung Newsroom

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate