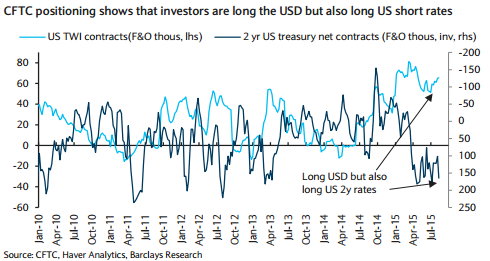

In terms of positioning, USD longs are still near peak levels with every currency net short versus the dollar currently, suggesting investors are positioned for a Fed hike in FX markets. Barclays expects the Fed's rate hike in September, investors remain divided over the timing of the hike.

On the other hand, net longs in US 2y rates are at very high levels. Positioning in eurodollar futures is also modestly net long when it has been net short around the 1999 and 2004 hiking cycles as well as the taper tantrum. "Given the positioning disconnect, it appears that short rates may be the better option to position for Fed hikes rate", suggests Barclays.

Investors positioned for Fed hikes in FX

Thursday, August 20, 2015 5:41 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic