According to the latest report from ANZ Research, it is unnecessary for the People’s Bank of China (PBoC) to employ broad-based monetary easing. We may see marginal tightening in interbank market liquidity conditions and hence a rise in short-end rates.

China’s central bank is focusing on credit easing and improving the transmission mechanism of monetary policy with targeted measures. This has been effective so far, as evidenced in the acceleration in loan growth in July.

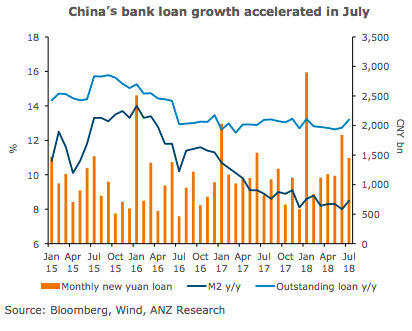

Further, the rise in bank loans in July suggests that China’s policy actions have been effective. New yuan loans jumped to CNY1.45 trillion in July this year, compared with CNY0.83 trillion in July last year and CNY0.46 trillion in July 2016.

As a result, outstanding CNY loans expanded 13.2 percent in July compared with 12.7 percent in June, and the M2 broad money supply rose 8.5 percent y/y in July compared with 8.0 percent in June. Although shadow banking activities are still shrinking, as reflected in July’s aggregate financing (CNY1.04 trillion or 10.3 percent y/y) figures, the acceleration in bank loan growth will support overall financial conditions.

Meanwhile, fiscal policy will continue to contribute more to stabilising total demand. The recent debates between the PBoC and the Ministry of Finance (MoF) have attracted much publicity in China. Following this, the minutes from the executive meeting of the State Council on July 30 stated that “the proactive fiscal policy should be more effective", the report added.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal