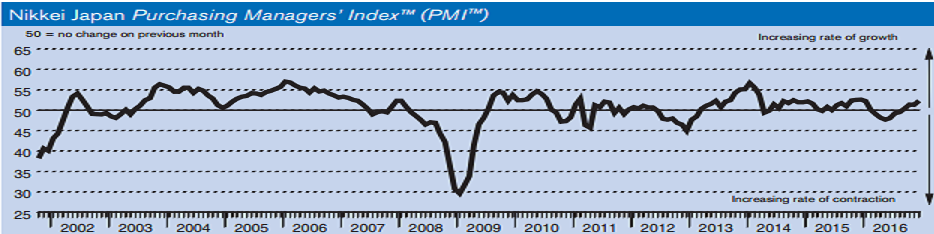

Manufacturing activity in Japan improved sharply during the month of December, hitting 1-year high during the period, following upbeat performance in production as well as new orders. Also, it widely beat market expectations, remaining starkly above the 50-point neutral mark.

The headline Nikkei Japan Manufacturing Purchasing Managers’ Index (PMI) posted 52.4 in December, up from 51.3 in November, signalling a sharper improvement in manufacturing conditions in Japan. In fact, the latest reading was the highest since December last year and contributed to the strongest quarterly average since Q4 2015.

The higher figure reflected increases in output, new orders and employment. Production at Japanese manufacturers rose for the fifth consecutive month. Moreover, the rate of expansion was the sharpest registered during 2016.

Further, a stronger expansion in production was matched by a faster increase in new orders during December. New order growth accelerated to a 12-month high, with a number of firms mentioning improved advertising campaigns.

Also contributing to the rise in total new orders was an increase in international demand, with new export orders expanding for the fourth month running. On the price front, reports of greater raw material prices, particularly for oil- and metal- related items, stemming from the weakness of the yen led to a sharper increase in input costs.

Meanwhile, the USD/JPY traded at 118.03, up 0.24 percent, while at 5:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at -37.82 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off