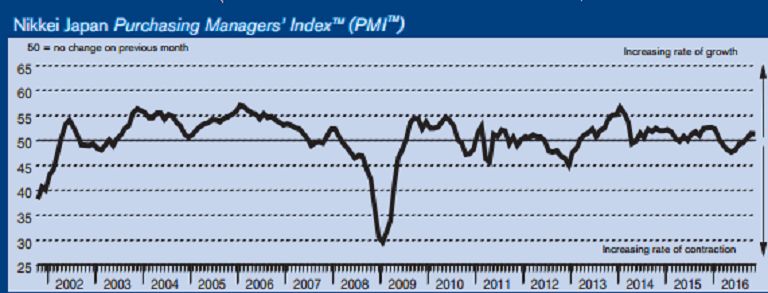

Japan’s manufacturing sector performed best in almost a year during November, remaining higher than the series’ long-run average. Production increased at a slightly slower pace, albeit one that remained stronger than the long-run series average. This was driven by new order growth, which picked up to a ten-month high.

The headline PMI posted at 51.3 in November, little-changed from October’s 51.4, the highest reading since January, thereby signaling a solid improvement in manufacturing conditions in Japan. In contrast, employment growth eased to the weakest in three months. Meanwhile, on the price front, input prices and charges remained broadly unchanged from October.

Total new orders also increased in November. In fact, the rate of expansion was the most marked since January. Greater foreign demand also contributed to the expansion in total sales, with new export orders increasing for the third successive month. The rate of growth eased, but was nevertheless stronger than the historical average.

Finally, input prices broadly stabilized, following a ten-month sequence of decline. Selling prices also remained broadly unchanged from October.

Meanwhile, the USD/JPY currency pair has weakened, forming a bearish pattern at 113.95, down 0.42 percent, while at 6:00GMT, the FxWirePro's Hourly Yen Strength Index remained slightly bearish at -82.45 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains