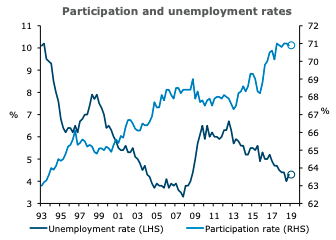

New Zealand’s unemployment rate is expected to stabilize at 4.3 percent during the first quarter of this year; however, further improvement in the near term seems unlikely with GDP growth subdued, according to the latest report from ANZ Research.

Further, wage inflation is expected to have firmed to 2.1 percent y/y, reflecting both previous tightening in the labour market and minimum wage increases. Labour market data has been volatile in recent quarters; last quarter markets saw a rise, but the general trend has been a gradual tightening.

Employment growth is expected to soften from 2.3 percent to 2.2 percent y/y. Employment is expected to have grown 0.5 percent in the quarter, with an element of bounce-back from last quarter’s weak 0.1 percent q/q print, the report added.

MBIE job ads are noisy, but are consistent with robust employment growth in the quarter. Labour force participation is expected to have remained elevated near 71 percent of the working-age population.

The labour market has been robust in the context of the recent GDP growth slowdown, with employment near its maximum sustainable level.

Going forward, the labour market is expected to tighten only very modestly over the medium term, once OCR cuts provide a bit of stimulus to the economy. Employment growth is expected to remain modest, with the participation rate stable at a high level and migration coming off its peak.

"While the timing is uncertain, we remain of the view that in the context of cooling capacity pressures OCR cuts will be needed to keep the labour market near its maximum sustainable level and return inflation sustainably to target," ANZ Research further commented in the report.

Image Courtesy: ANZ Research

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy