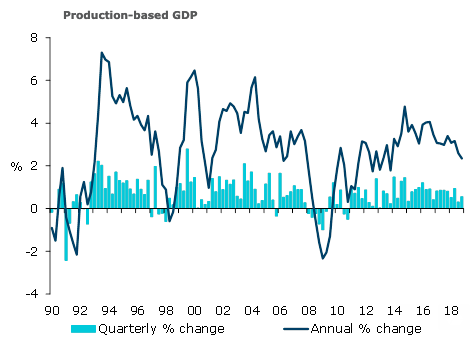

The New Zealand economy grew 0.6 percent q/q in the fourth quarter of last year, in line with market expectations. This saw annual growth slow from 2.6 percent in Q3 to 2.3 percent in Q4 (annual average growth eased from a revised 3.1 percent in Q3 to 2.8 percent in Q4).

However, today’s print was below the RBNZ’s February MPS forecast for growth of 0.8 percent q/q, pushing their outlook for an acceleration in annual growth to 3.1% this year a little further into ‘optimistic’ territory.

Turning to the details of today’s release, solid 0.9 percent growth in services industries was the clear standout, with broad-based strength across the components. Both retail trade & transport and postal & warehousing surprised us on the upside, suggesting robust household demand. Q4’s solid rise was on the back of soft services growth in Q3 (just 0.5 percent), suggesting there was an element of timing in last quarter’s weakness.

Growth across goods-producing industries was on the weaker side, at 0.2 percent q/q. Construction came in a little softer than expected, up 1.8 percent. Primary industries GDP contracted 0.8 percent, with both mining (-1.7 percent) and agriculture, forestry and fishing (-0.6 percent) soft.

Per capita growth of just 0.1 percent q/q was weak, particularly in the context of downward revisions to Q3 growth (from 0.0 percent to -0.1 percent). This saw New Zealand narrowly dodge a per capita technical recession such as has been seen in Australia. Annual growth in this measure continued to moderate and is now running at just 0.9 percent.

Meanwhile, implied labour productivity growth looks underwhelming, with population growth remaining the key driver of headline GDP growth. Admittedly, per capita measures have become more uncertain since the implementation of outcomes-based migration data, ANZ Research reported.

Image Courtesy: ANZ Research

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality