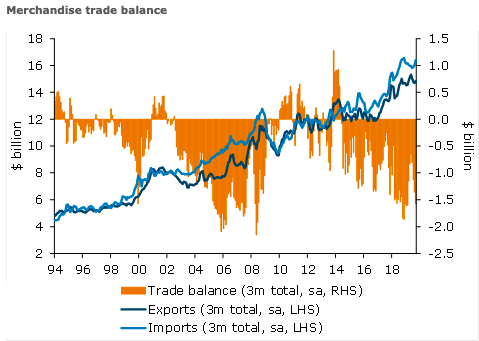

New Zealand’s trade deficit for September was pegged back to $1.24 billion following a particularly large deficit the previous month. Exports lifted to $4.47 billion while imports were also stronger lifting to $5.71 billion; the annual trade balance narrowed to -$5.21 billion, ANZ Research reported.

September delivered an unadjusted monthly trade deficit of $1.24 billion, which was slightly smaller than anticipated. On an unadjusted basis, export returns were up 5.1 percent y/y in September while imports were down 2.1 percent.

Dairy export returns were strong, up 20.4 percent m/m on a seasonally adjusted (sa) basis, while volumes were up 13 percent. Meat export volumes were up 8.6 percent sa in September despite there not being a lot of stock available for processing. In value terms meat exports were up 21.5 percent sa from the previous month.

Log export returns in the September quarter fell 13.7 percent from the previous quarter as both prices and export volumes fell. Export volumes were back 5.8 percent sa. The importance of China as an export destination continues to grow. The value of goods exported to China has increased by 20.3 percent over the past year.

The value of fruit exported in September was back 19.1 percent y/y. The weaker September data was mainly driven by weaker returns from kiwifruit for the month. Kiwifruit returns are up for the season to date, and total fruit exports for the three months to September were up 6.2 percent. The harvest period for the higher value gold kiwifruit is earlier than the green varieties.

September was a strong month for imports which is expected as importers stock up for Christmas demand. However this was tempered by a weak month for petrol imports which were back 26.6 percent on the previous month.

"Looking forward, export volumes for October will be bolstered by the increase in dairy production – September milk production was up 0.7 percent on a milk solid basis with the products manufactured from this milk ready to be exported in October. We are likely to see an uptick in petrol imports next month following lower imports in September," ANZ Research further commented in the report.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed