New Zealand’s headline consumer price inflation for the first quarter of this is expected to come in at 0.4 percent q/q, which would see annual inflation slow from 1.6 percent to 1.0 percent y/y, a touch below the Reserve Bank of New Zealand’s (RBNZ) expectation of 1.1 percent, according to the latest report from ANZ Research.

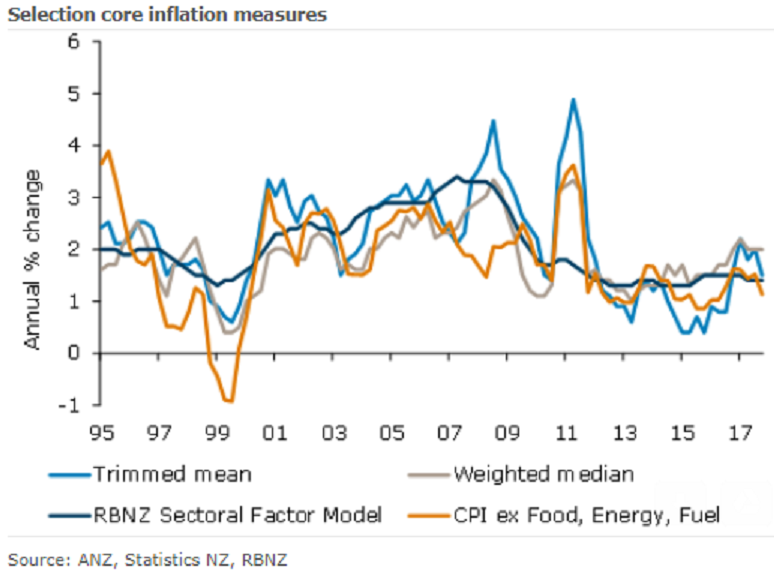

Nonetheless, evidence of a broadening in domestic price increases beyond housing remains elusive. Core inflation measures are expected to be broadly stable. Policy-induced price rises will be broadly offsetting, with higher tobacco duty offsetting fees-free first-year tertiary education.

The usual annual increase in tobacco excise duty is expected to make a 0.3 percentage point q/q contribution, while the fees-free first-year tertiary education policy will broadly offset this, with a 4 percent fall in the education group instead of its typical Q1 rise.

"We expect a 0.8 percent q/q lift in non-tradable inflation, which would see annual inflation in this measure dip to 2.2 percent. We expect inflation to pick up again over coming quarters. Core inflation measures such as the weighted median and trimmed mean should smooth through this noise," the report added.

Meanwhile, the RBNZ is expected to continue to bide its time until there’s a little more certainty that inflation is set to rise. But with a new Governor, there is naturally more uncertainty than usual, and Mr. Orr’s first Monetary Policy Statement on May 11 will be perused with great interest, despite a clear market expectation of an unchanged OCR for a long time yet.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal