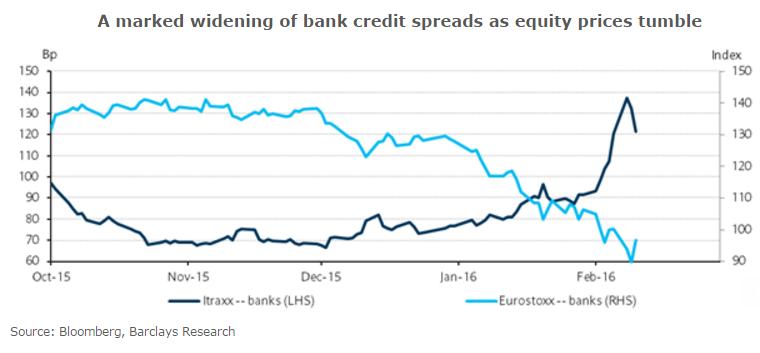

European banks' credit and equity are at levels not seen since 2012-13. The 2008-09 financial crisis and the negative impact on the banking sector has created a significant level of non-performing assets. Despite provisions and capital buffers being raised, the ratio of non-performing loans to capital remains elevated. Also growing concerns about the strength of the business (and credit) cycle in the past few weeks have created a sharp widening in bank credit spreads.

Also ECB negative interest rates at -30bp is squeezing euro area banks' net interest margins. The longer negative rates remain, the longer their profitability will likely remain impaired, unless euro area activity accelerates. Markets are also fully pricing the depo rate at -50bp by H2 16, a further drag on sentiment. Bank equity prices have fallen sharply to levels not seen since August 2012.

"We do not expect bank regulators to ease standards, reduce regulatory risk weights and, ultimately, reduce capital requirements (at least not without clear evidence that growth dynamics have turned down sharply, which is not our base-case scenario for now). Hence, we expect banks to face a challenging regulatory and P&L environment." said Barclays Capital in a research note.

Credit Default Spreads have spiked, including for the largest European banks as equity prices tumble. Tight financing conditions and increased global uncertainty may well pressure the fragile euro area investment recovery and eventually slow consumption and thus put significant downside risk on the euro area's 2016-17 growth outlook. EUR/USD was trading at 1.1288 at 0940 GMT.

"In our opinion, these conditions will not be supportive of bank credit spreads and equity prices in the future, even if European bank-equity valuations might appear cheap by some metrics. We believe only hard evidence of a slowdown or recession risk in the euro area could lead to materially different policy setting in Europe. We do not envisage any significant changes to the ECB's gradual monetary policy approach," adds Barclays.

No change likely in ECB's gradual monetary policy approach despite downside risk to euro area's 2016-17 growth outlook

Friday, February 12, 2016 11:17 AM UTC

Editor's Picks

- Market Data

Most Popular

9

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says