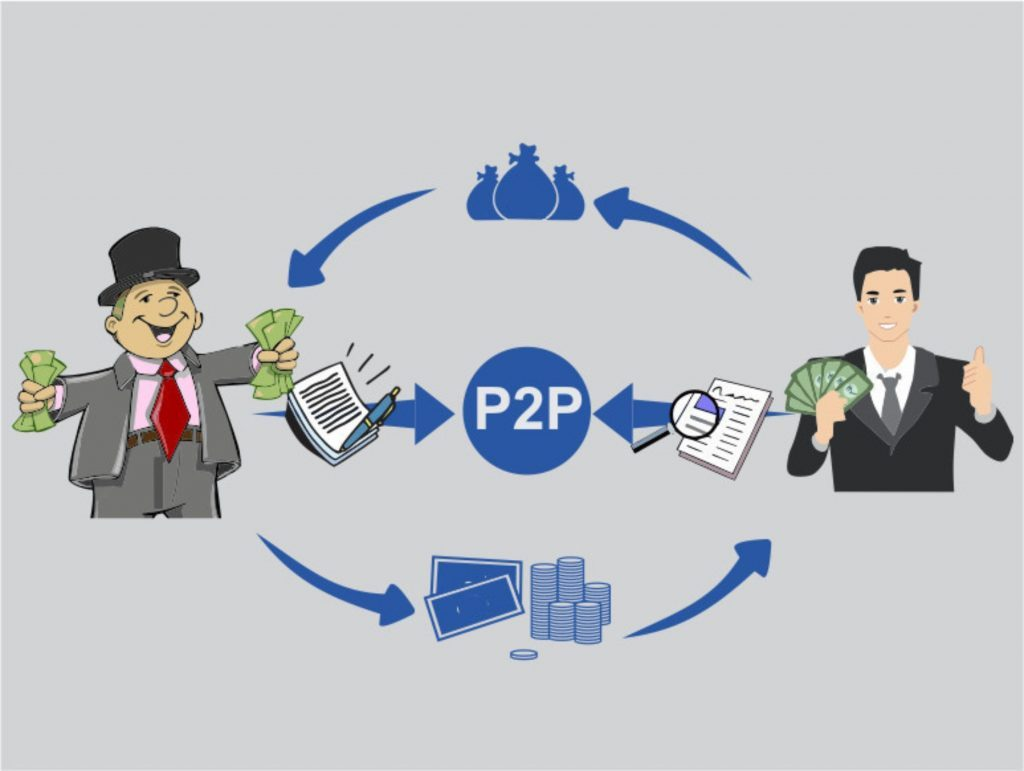

P2p lending is a method of financial transactions in which money is borrowed without the participation of banks. And the lender is not a corporation but an individual. The abbreviation p2p stands for peer-to-peer. Another decryption option is Person-to-Person.

The Essence of Mutual Lending

Lending venues are p2p lending sites. A person is registered there as a borrower or lender, after which he can take or give loans. The exchange is not a creditor, but it plays an important role, acting as an intermediary in transactions and checking the reliability and solvency of borrowers.

Despite the outward simplicity of conducting operations, the p2p service involves studying the credit history of borrowers and creating a confidence rating to reduce investor risks. Relations between the lender and the borrower are held together in a contractual format. The contract has legal force and can be used as confirmation in the course of litigation. But it rarely comes to trial.

The attractiveness of this credit system is that it is beneficial for both parties. The percentage of the lender’s return on investments in p2p is higher than the percentage on bank deposits. And the borrower can quickly take small amounts of money for the short term, passing a less stringent check of his reliability.

Risks and Weaknesses

P2p lending has the following risks:

- Since the contact of the lender and the borrower passes only through the Internet, it is easier for the latter to hide with the money received and not return it.

- Although exchanges test users for reliability, their degree of control is not as great as in banks. Often, citizens with a negative credit history are allowed to register.

- Automated verification and rating systems are easily fooled by an experienced scammer. Counterfeit documents, fake accounts, and other methods can go into business.

- Fraudsters practice this way of earning. For example, the user takes and timely returns several inexpensive loans. This allows him to get a high rating, with the help of which he receives expensive loans on favorable terms and does not return them. Exchanges try to fight this scheme in different ways.

- Many sites do not work with bank transfers, but with electronic money, the circulation of which is regulated and protected not so strictly.

Reviews

Although p2p lending is described by some publications as a replacement for the banking system, most Internet users are more skeptical. The opacity of Internet schemes, the relatively low amount of investment, and the lack of full-fledged functionality of large financial organizations do not allow p2p to be perceived as a complete alternative to classical banking.

This is a niche industry. But within its niche, this system has the right to live. In such areas as small consumer lending, financing of small businesses and start-ups, and urgent loans for urgent needs, the p2p system is doing well and has bright prospects for further development.

This article does not necessarily reflect the opinions of the editors or management of EconoTimes.

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies