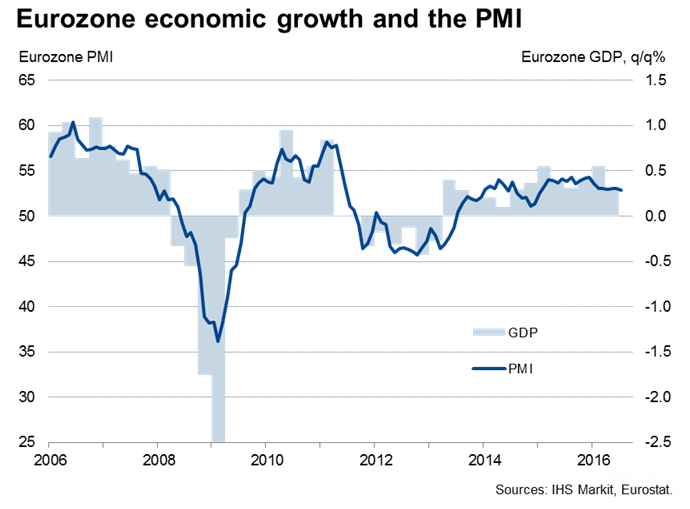

According to the preliminary estimates released on Friday, the Euro area recorded a tepid economic growth of 0.3 percent q/q in the second quarter of 2016. The reading was in line with market expectations but was well short of 0.6 percent q/q growth recorded in the previous quarter.

After the strong growth in the first quarter which was helped by some temporary factors like the mild winter weather, some pay-back in the second quarter was expected. On a yearly basis, eurozone GDP was up 1.6 percent, slightly less than the upwardly revised 1.7 percent recorded in the first quarter.

French statistics office released GDP data earlier on Friday which showed growth of the euro zone's second-largest came in at a worse-than-expected at zero due to weak consumer spending. The disappointing zero percent growth in France, largely due to a decline in inventories, was one of the culprits behind the weaker Eurozone growth performance.

It is worth noting that today’s release refers to economic growth in the three months to June, ahead of the UK’s vote to leave the EU. Also, GDP figures for big member states comprising Germany and Italy still have to be published, implying that today’s figure is prone to revision.

"Risks of a downward revision to these data are high. The great unknown is German GDP, and more specifically capital expenditure in the construction industry," said Claus Vistesen at Pantheon.

In a separate report, the eurozone flash HICP inflation estimate showed that headline inflation came out at 0.2 percent in July, slightly higher than expected 0.1 percent. The reading which was its highest since the end of last year was driven by food, alcohol and tobacco. Today’s set of data gives policy makers only limited comfort as inflation remains uncomfortably low.

"The case for the ECB to announce further policy easing in September will continue to strengthen. We have pencilled in a cut to the deposit rate from -0.4 percent to -0.5 percent and an increase in the monthly pace of asset purchases from €80bn to €90bn." said Nick Kounis at ABN Amro.

The common currency keeps the firm footing at the end of the week post-EMU data. EUR/USD advanced further to hit highs of 1.1114 and was trading at 1.1110 at 11:30 GMT, while EUR/GBP was trading at 0.8430.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record