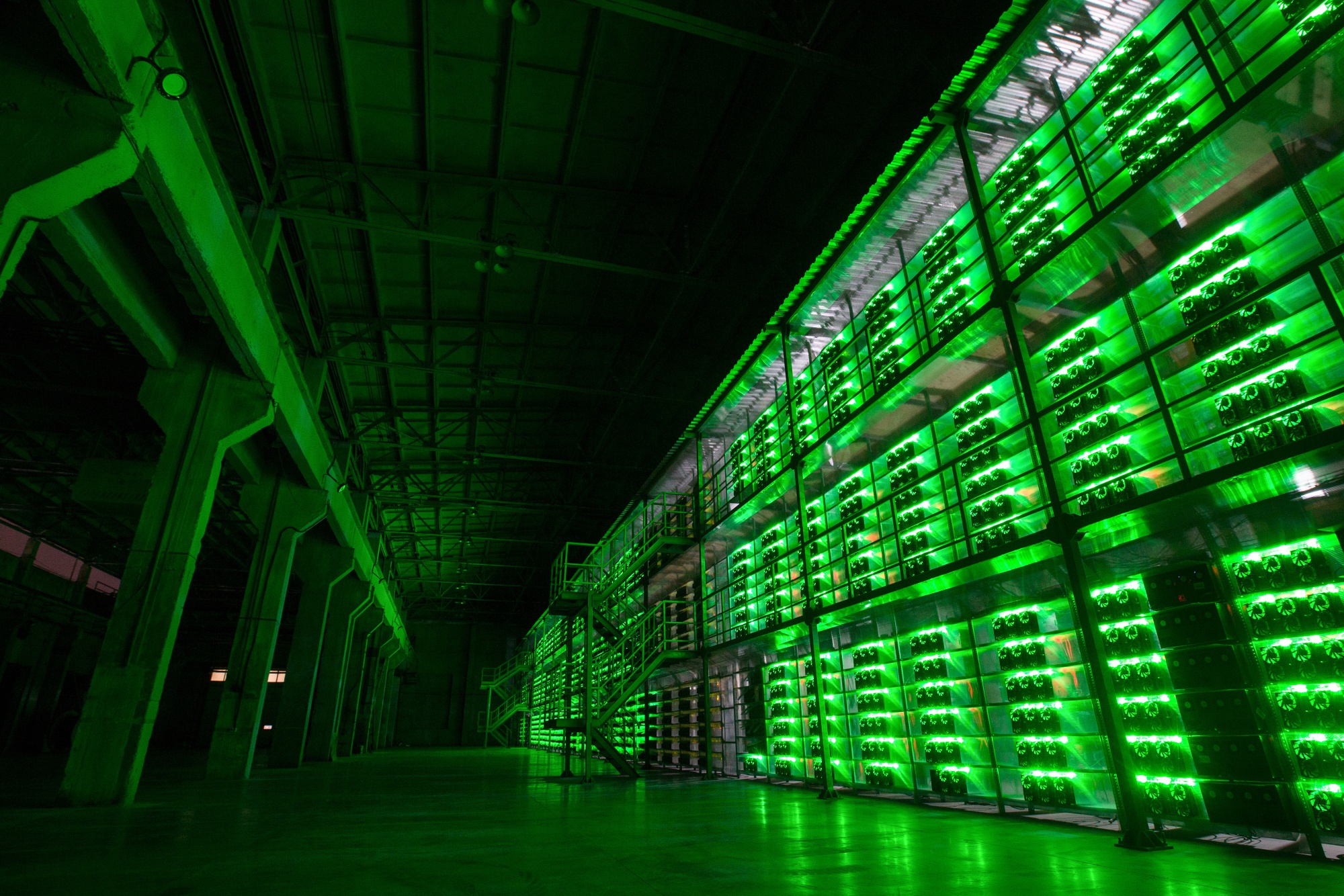

Russia is considering slapping special energy tariffs on cryptocurrency miners after China's industry ban triggered a wave of migration.

There was an exodus of cryptocurrency miners to Russia after bitcoin mining operations in China were told to shut down in June.

China's clampdown also resulted in other countries such as the US, and Kazakhstan seeing a rise in cryptocurrency mining activity.

Energy Minister Nikolai Shulginov is exploring ways to distinguish energy consumption for cryptocurrency mining to prevent miners from consuming electricity at residential tariffs and maintain the reliability and quality of the power supply.

Russia President Vladimir Putin also expressed concern about the energy-intensive process of cryptocurrency extraction, which would require the use of traditional sources of energy, primarily hydrocarbons.

However, Deputy Minister of Finance Alexey Moiseev also said that Russia is not planning to follow China's footsteps in banning its citizens from buying cryptocurrency.

While press secretary Dmitry Peskov said in early September that their country is not ready to recognize bitcoin, Russia has been advancing towards regulating its crypto space, which includes the adoption of relevant legislation such as their Digital Financial Assets law.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off