South Korea’s stock market regulator has issued a second formal alert on SK Hynix (KS:000660) after the chipmaker’s share price soared more than 200% over the past year. The Korea Exchange (KRX) designated the company as an “investment warning stock” for one day on Tuesday, escalating from the “investment caution” notice it issued last month. The move is part of the exchange’s efforts to prevent excessive speculation and protect investors amid unusually sharp price movements in one of the market’s most closely watched semiconductor stocks.

According to the KRX, several criteria triggered the latest warning. These include SK Hynix’s year-on-year share price jump exceeding 200%, the stock hitting a 15-day high, and significantly elevated trading activity among its top 10 accounts in recent sessions. Under the exchange’s risk-control framework, the warning places the company on a watch-list that could lead to stricter measures, including potential trading suspension, if volatility continues.

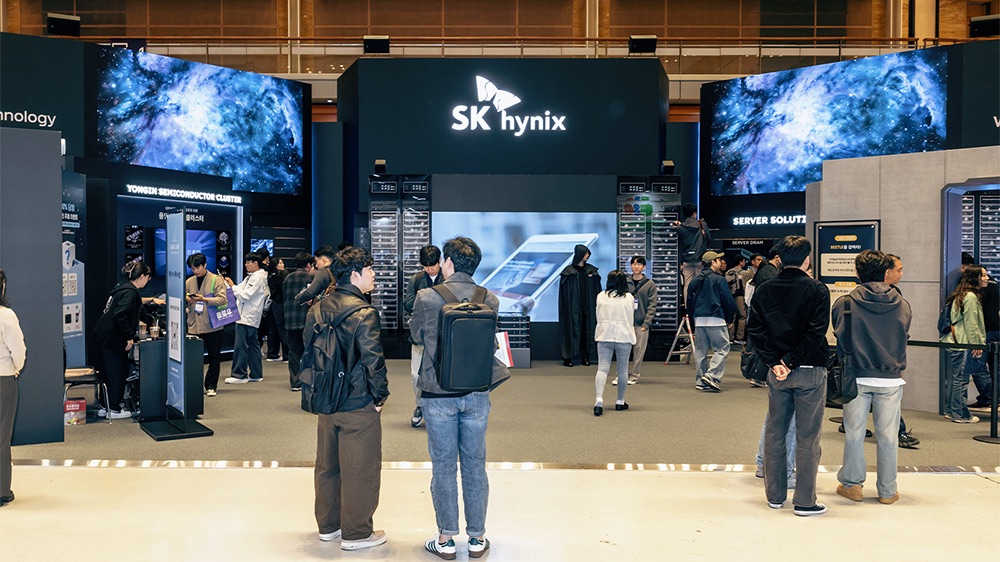

Investor enthusiasm surrounding SK Hynix has surged in parallel with the global AI boom. The company, a major supplier of high-performance memory chips to NVIDIA Corporation (NASDAQ: NVDA), has benefited from accelerating demand for advanced DRAM and HBM solutions used in artificial intelligence systems and data-center infrastructure. As AI workloads expand worldwide, market expectations for SK Hynix’s growth have intensified, helping propel its stock to record levels.

While the KRX’s intervention does not directly restrict ordinary trading, it serves as a warning for investors to carefully assess the risks amid rapid price appreciation. The situation highlights how the AI-driven semiconductor rally is reshaping capital markets, even as regulators step in to curb potential overheating.

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off