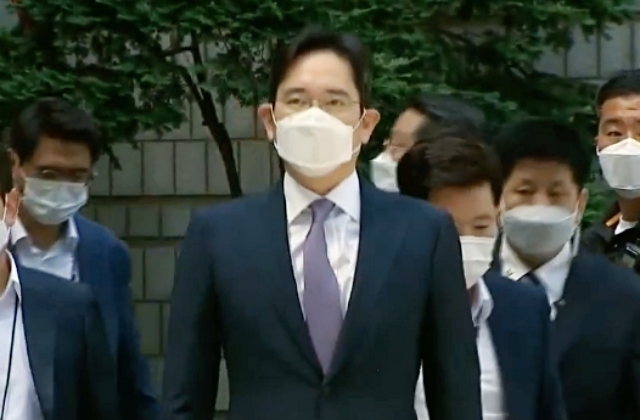

Lee Jae Yong, the Samsung heir and currently leading the company, has been released from prison earlier than he was sentenced for. This happened as businessmen, and some politicians petitioned for his early release through pardon.

Business leaders stepped up to request for Lee Jae Yong’s release because they said Samsung needs its head, especially at this time when chip shortage has been creating problems for most companies in the tech and automotive industries. They also reasoned that without Lee in the office, foreign companies could benefit from the businesses that Samsung will not be able to do as its chief is not able to work.

In any case, Lee Jae Yong has other offenses aside from the bribery and embezzlement cases that he was previously convicted of. One of them is his alleged illegal use of propofol, and the verdict for this case has been handed down recently.

According to The Korea Herald, the Samsung leader will have to pay ₩70 million in fines or around $59,200. This means the court found him guilty for the use of the anesthetic medication when he has not been medically prescribed with it.

The court revealed the final decision this week. It was reported that the fine was finalized as the prosecutors and Lee Jae Yong have not filed an appeal during the deadline or the last day of the seven-day window to submit an appeal to the court.

Last week, the Seoul Central District Court ordered the Samsung leader to pay a fine for violations of South Korea’s Narcotics Control Act. Since he did not file an appeal for this, it was determined that he would settle the hefty fine.

Lee Jae Yong was first indicted for illegal propofol use in June. Based on the court documents, he took the medication for a total of 41 instances between January 2015 until May of last year. He was said to have used the regulated medication for other use and not for medical treatment.

Asian Stocks Tumble as US-Iran Conflict Escalates and Oil Prices Surge

Asian Stocks Tumble as US-Iran Conflict Escalates and Oil Prices Surge  Netflix Declines to Raise Bid for Warner Bros. Discovery Amid Competing Paramount Skydance Offer

Netflix Declines to Raise Bid for Warner Bros. Discovery Amid Competing Paramount Skydance Offer  Japan Manufacturing PMI Jumps to Four-Year High as Global Demand Strengthens

Japan Manufacturing PMI Jumps to Four-Year High as Global Demand Strengthens  Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation  Qantas Shares Plunge 10% as Iran Strikes Send Oil Prices Soaring and Disrupt Global Flights

Qantas Shares Plunge 10% as Iran Strikes Send Oil Prices Soaring and Disrupt Global Flights  Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand

Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand  Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand

Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand  U.S. Stocks Close Lower as Hot PPI Data, Nvidia Slide Weigh on Wall Street

U.S. Stocks Close Lower as Hot PPI Data, Nvidia Slide Weigh on Wall Street  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology  Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure

Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets

Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets  Australian Job Advertisements Hit 16-Month High as Labour Market Stays Resilient

Australian Job Advertisements Hit 16-Month High as Labour Market Stays Resilient  OpenAI Secures $110 Billion Funding Round at $840 Billion Valuation Ahead of IPO

OpenAI Secures $110 Billion Funding Round at $840 Billion Valuation Ahead of IPO  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade