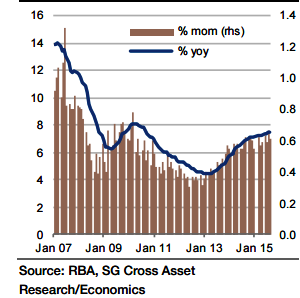

Australia's October Private Sector Credit came in at 0.7% on month on month basis, same as per the expectations by market consensus and modestly less than that of previous month's 0.8% mom.

The overall private sector credit growth for the month of September was higher than the consensus expectations of 0.5% and recorded highest for 7 years.

The affordability owing to solid appreciation in prices is falling. There is no reliability in the split between owner-occupiers and housing investors, due to re classifications, shifting te focus on total housing loans.

"The major banks' autonomous mortgage rate increase of 15-20bp in October is unlikely to have left any discernible mark on the latest data quite yet, but over the coming months some marginal impact should be expected", says Societe Generale in a research note.

Surge in loans to businesses drives Australian Private Sector Credit growth

Monday, November 30, 2015 5:29 AM UTC

Editor's Picks

- Market Data

Most Popular

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX