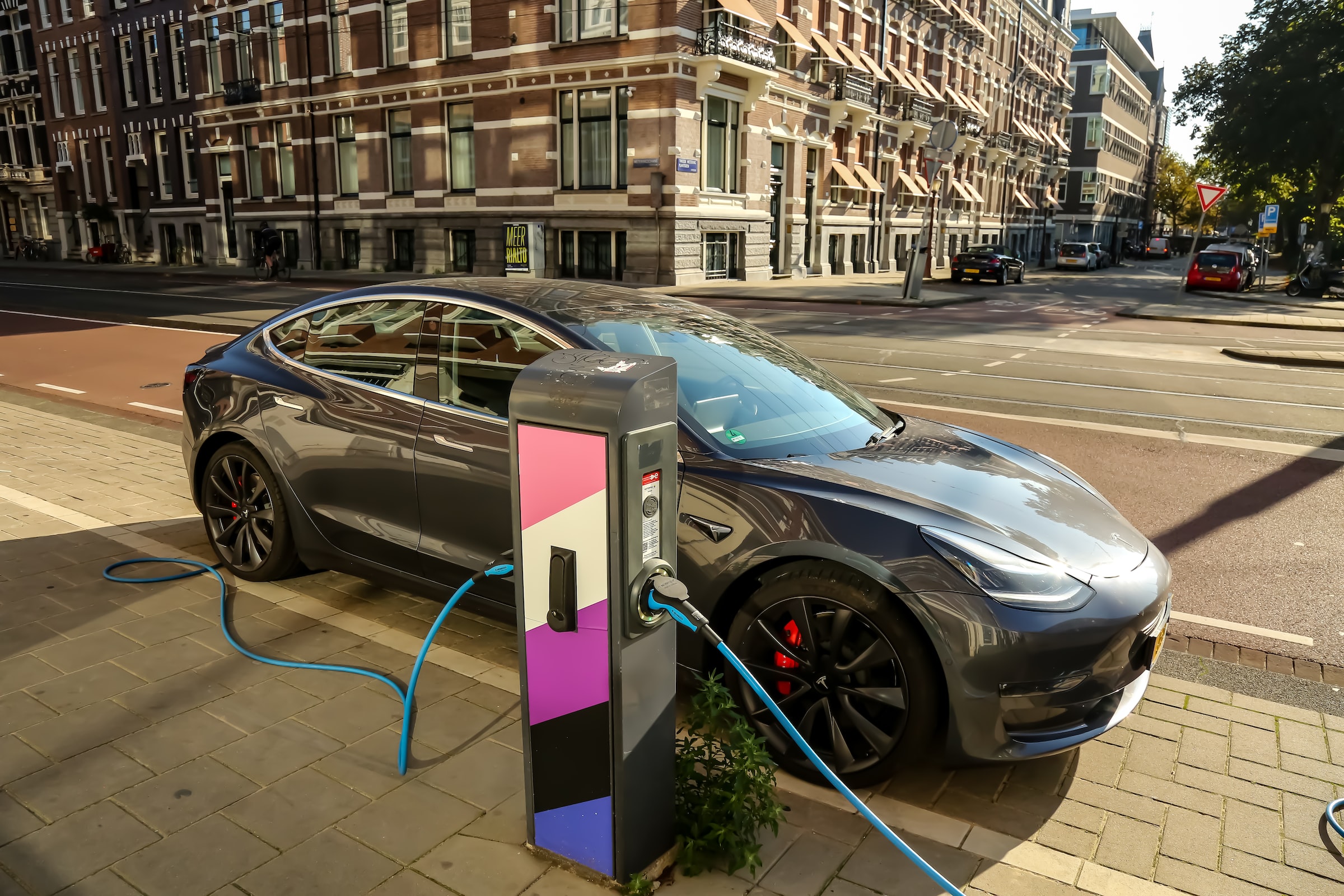

Tesla Inc. is making a rare offer as the year 2022 is about to close. The electric vehicle maker is selling some of its best-selling car models with up to $7,500 discounts in the United States and Canada.

Tesla is selling two of its top models - Model 3 and Model Y at discounted prices this month. The automaker owned by Elon Musk announced the sale through its official website.

As per Reuters, the year-end offer has been unleashed amid concerns Tesla is facing a decline in demand due to the slowdown in economies. In any case, the company will grant a $7,500 credit in the U.S., and a $5,000 credit has been assigned in Canada for the Model Y and Model 3 units that will be purchased and delivered before the end of the year.

What’s more, it is also giving away free supercharging for 10,000 kilometers or 6,000 miles. It was noted that the American EV brand is one of the major beneficiaries of President Joe Biden's administration's Inflation Reduction Act or IRA. Under this act, the company can enjoy rebates of up to $7,500 on vehicle purchases.

This law was implemented for carmakers to lessen their reliance on China. This newest discount was said to have been announced just days after the U.S. Department of Treasury delayed the release of its proposed guidance on the prescribed sourcing of EV batteries.

Tesla has also given a discount for purchases of some EV models in China. Buyers enjoyed $860 or 6,000 yuan less for their cars bought in the last week of this month.

In any case, Associated Press News reported that Tesla’s discounts come ahead of a new federal tax credit that is set to take effect on Jan. 1, 2023. Previously, the EV automaker was not eligible for this federal tax credit program as it has reached the limit of 200,000 vehicles sold, while next year, the limit rule for the credits has been eliminated.

“This is a sign of demand cracks and not a good sign for Tesla heading into the December year-end,” Dan Ives, an analyst at Wedbush, said in a statement that was sent via email. “EV competition is increasing across the board, and Tesla is seeing some demand headwinds.”

Photo by Rick Govic/Unsplash

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links