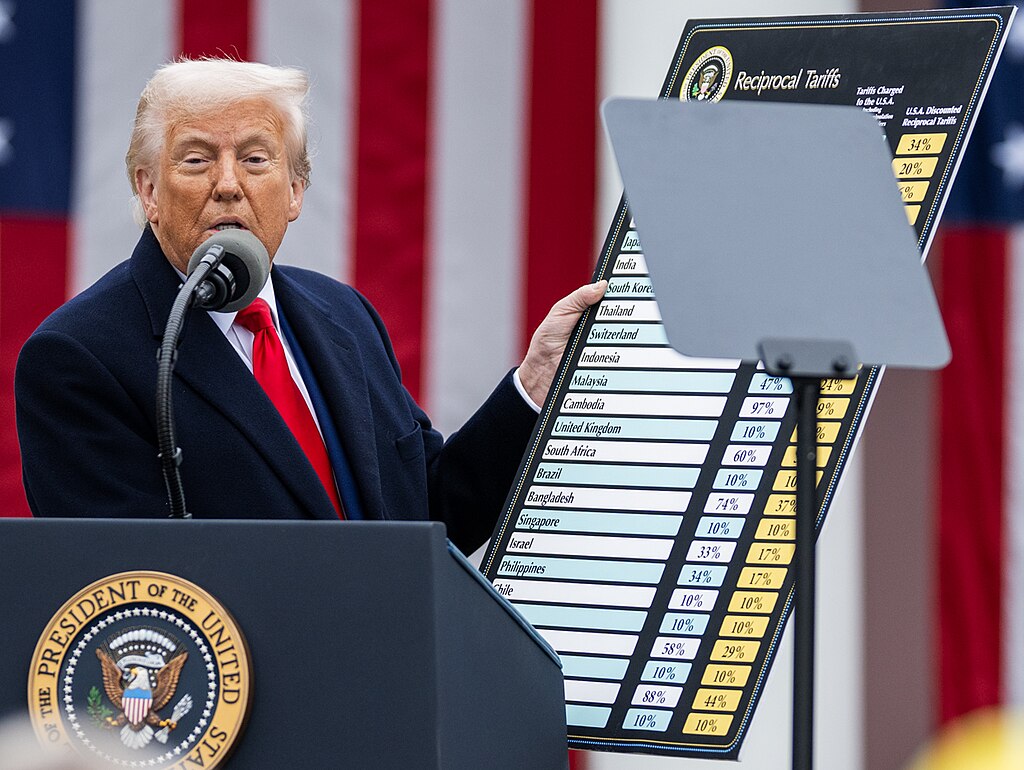

U.S. President Donald Trump announced plans to send formal tariff notices to major trading partners within the next two weeks, ahead of a July 9 deadline for finalizing trade deals. Speaking at the Kennedy Center on Wednesday, Trump said, “We’re just going to send letters out saying ‘this is the deal,’ you can take it or leave it.”

Trade negotiations are ongoing with countries including Japan, South Korea, and over a dozen others. However, it remains uncertain whether Trump will follow through on the deadline, as previous tariff threats have often been delayed or extended. When asked if he would postpone the July 9 deadline, Trump responded, “I would, but I don’t think we’re going to have that necessity.”

Dubbed “liberation day” tariffs, the proposed duties are set to take effect in early July. Originally announced in April, they were granted a 90-day extension to allow for trade discussions. Trump has threatened significant tariffs on key U.S. trading partners if agreements aren’t reached, aiming to secure more favorable terms for American exports and manufacturing.

So far, only a formal trade agreement with the United Kingdom has been signed, while a framework deal with China was recently announced. Trump claimed on Wednesday that the China deal was “done” and included a commitment from Beijing to supply rare earth materials to the U.S., though specific terms were not disclosed.

The administration’s aggressive trade stance signals a renewed push for bilateral deals, with tariffs used as leverage. Investors are watching closely as geopolitical and economic implications from these negotiations could impact global markets in the weeks ahead.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Sanctions on Russia Could Expand as Ukraine Peace Talks Continue, Says Treasury Secretary Bessent

U.S. Sanctions on Russia Could Expand as Ukraine Peace Talks Continue, Says Treasury Secretary Bessent  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Rejects Putin’s New START Extension Offer, Raising Fears of a New Nuclear Arms Race

Trump Rejects Putin’s New START Extension Offer, Raising Fears of a New Nuclear Arms Race  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  NATO to Discuss Strengthening Greenland Security Amid Arctic Tensions

NATO to Discuss Strengthening Greenland Security Amid Arctic Tensions  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border