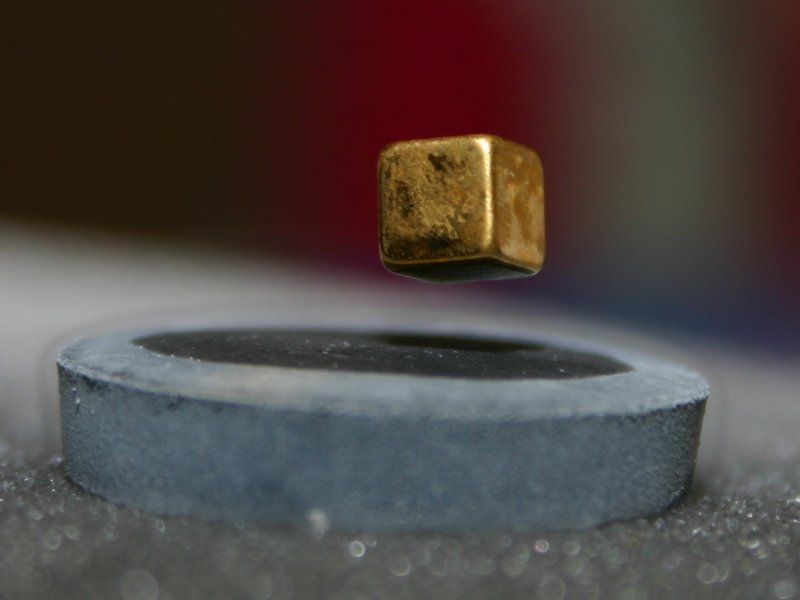

The U.S. is intensifying efforts to reduce China’s dominance in the rare earths market by introducing a separate pricing system backed by the Department of Defense (DoD). This move includes a deal with MP Materials, the sole U.S. rare earth miner, to guarantee a minimum price of $110/kg for neodymium and praseodymium (NdPr)—roughly double the current China-set price of $63/kg.

China controls about 90% of the global rare earth supply, making it difficult for Western companies to compete due to artificially low prices. These critical metals are essential for defense technologies, electric vehicles, and wind turbines. The new U.S. benchmark is expected to shift global pricing dynamics, boosting incentives for domestic production while potentially raising costs for automakers and end consumers.

MP Materials, based in Las Vegas, plans to begin commercial magnet production in Texas by year-end. Under the new deal, the DoD will acquire a 15% stake in the company, which aims to scale up output to 10,000 metric tons annually—meeting U.S. domestic magnet demand.

Consultancies like Adamas Intelligence and Project Blue note that the pricing move could benefit other players like Solvay and Aclara Resources. However, questions remain about whether industrial buyers will absorb the higher costs or diversify supply chains. Demand for rare earth magnets is forecast to more than double globally to 607,000 tons by 2035, with the U.S. expected to grow at 17% annually.

Despite past efforts, Western governments have struggled to weaken China’s grip on the market. This pricing floor represents a major shift in strategy, moving beyond tax incentives toward more direct intervention aimed at securing supply chain resilience for strategic materials.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record