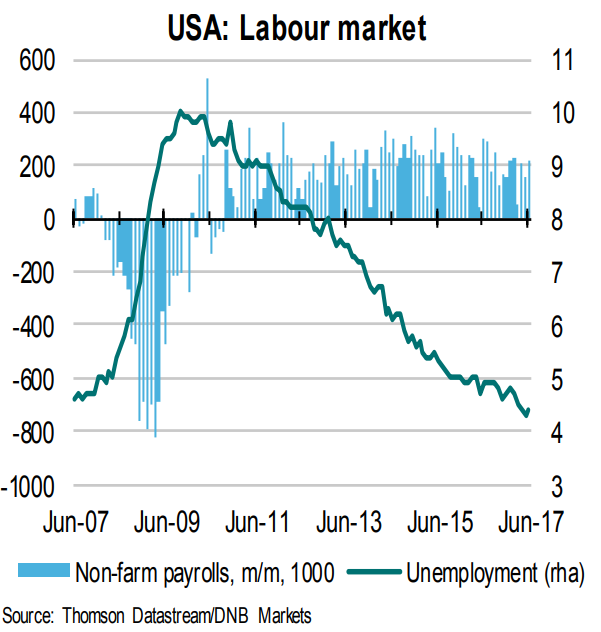

Friday’s US Non-Farm Payrolls report published by the Bureau of Labor Statistics (BLS) was mixed, providing something for bulls and bears alike. The headline number was better than expected but the unemployment rate rose from the earlier month. Data was far from perfect, but it certainly was reassuring for bulls on the US economy.

The BLS report showed US economy added 222,000 non-farm jobs in June beating consensus for 178,000. The May figure has been revised up from 138,000 to 152,000. Revisions to the previous two months’ of payrolls added 47k positions. The improvement was widespread with gains seen in the private sector employment and government payrolls. Private payrolls rose 187k, while government hiring rose 35k.

On the flip side, the unemployment rate increased to 4.4 percent from 4.3 percent in May. The labor participation rate was up 0.1 percentage points to 62.8 percent, consistent with its average over the last 12 months. However, wages continued to disappoint, with the average hourly earnings up just 0.2 percent, improving less than expected. The US economy continues to create new jobs without accompanying wage increases, which suggests that there's no sign of a tightening labor market yet. The NFP report does little to increase the pressure on the Federal Reserve to tighten policy.

"Overall, we think the NFP numbers seem to imply that the Fed may remain on track this year but without inciting additional bullishness. However, any carryover of USD resilience from last Friday may continue to be selective, and at this juncture, may primarily continue to manifest more effectively via USD-JPY. Meanwhile, the balance of evolving global central bank rhetoric may continue to remain in play and potentially still impinge on the USD," said OCBC Bank in a report.

Federal Reserve (Fed) Chair Janet Yellen’s semi-annual testimony is due on Wednesday and Thursday, where she is expected to reiterate the possibility of another Fed rate hike before the end of the year and could eventually provide a hint regarding the Fed’s balance sheet normalisation plans. The lack of further details should keep the US dollar loose.

At 1600 GMT on Monday, USD/JPY was trading at 114.18, slightly below fresh 2-month highs of 114.30 hit earlier on the day. Upside has broken consolidation phase after break of Symmetric Triangle pattern, we see scope for test of 61.8% Fib retrace of 118.662 to 108.130 fall at 114.63. The pair finds strong support at 111.78 (100-DMA), and only break below could see reversal of trend.

At the time of writing FxWirePro's Hourly Strength Index of US Dollar was neutral at 34.7225. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination