AAA video game company Ubisoft just made another huge stride in the mobile gaming industry with its announcement of acquiring Ketchapp. With over 20 million downloads a month, Ketchapp has an impressive repertoire and would definitely boost Ubisoft’s presence in the mobile industry. The acquisition comes with a few issues, however, namely the app company’s history of cloning other popular games.

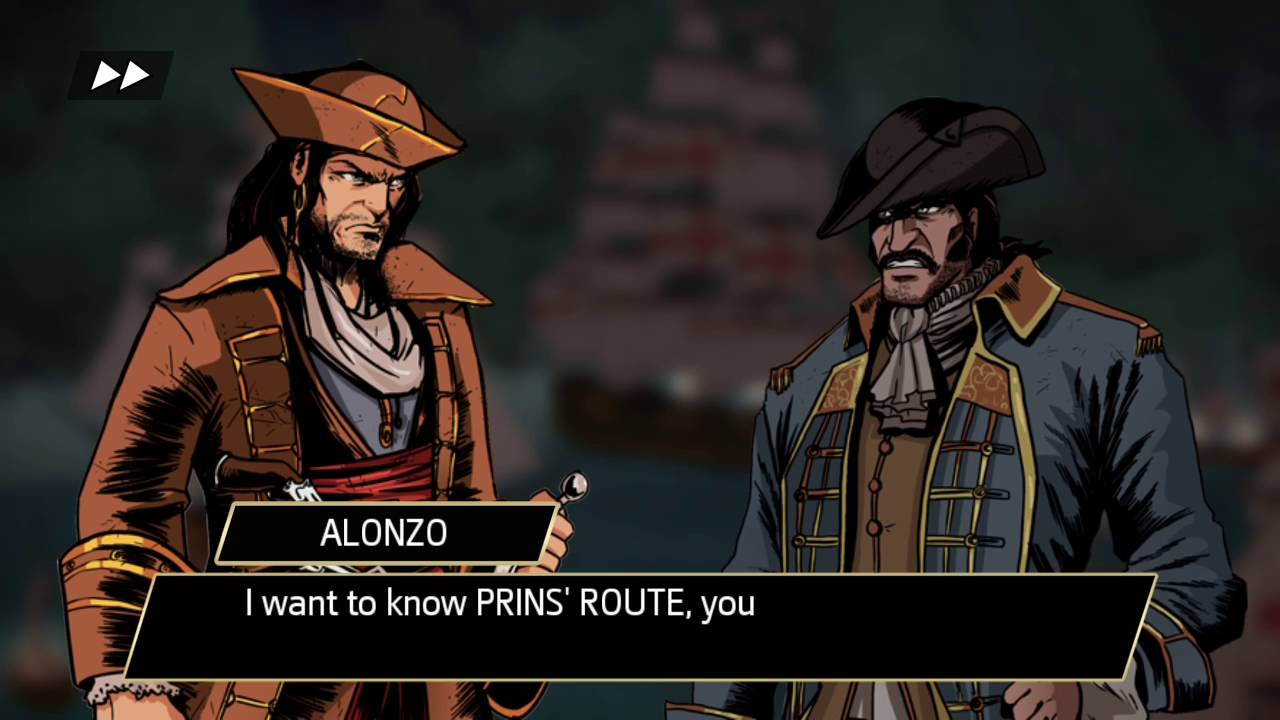

Ubisoft has been gaining a lot of ground in the mobile app market for several years now, thanks to popular titles like “Rayman Jungle Run” and “Assassin’s Creed Pirates,” Android Headlines reports. With the addition of Ketchapp’s considerable influence on the field, Ubisoft is primed for not only mobile success but also gives them a much wide audience to reach with ads pertaining to their AAA titles.

The deal isn’t set in stone yet, however, and will only be finalized on January 1, 2017. For now, Ubisoft will be hands-off and will not interfere with the design practices of Ketchapp.

As for the company itself, Ubisoft is quite ecstatic about the acquisition. The head of the company’s mobile division, Jean-Michel Detoc also explained exactly what getting Ketchapp will mean for the French entity.

"With Ketchapp, Ubisoft acquires a highly profitable publisher with a successful portfolio of free-to-play games for mobile,” Detoc said. “This acquisition gives Ubisoft one of the world's leading mobile game publishers and reinforces our advertising capabilities in mobile gaming."

With that said, Ketchapp’s rise to success since it was founded in 2014 isn’t exactly spotless. As Eurogamer notes, the company got embroiled in a tussle where it was accused of cloning the popular mobile app “Threes” in order to make their own game called “2048.”

“2048” became the company’s biggest title, which then catapulted it to fame. “Three’s” developer, Asher Vollmer commented on Ubisoft’s decision to buy Ketchapp via Twitter with thinly-veiled disdain.

It'd be cool if their games were mechanically & ethically higher quality tho

— Asher Vollmer (@AsherVo) September 27, 2016

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate