Vietnam's exports to the U.S. accounted for 30% of its GDP in 2023, the highest share among America’s major trade partners, making the country highly vulnerable to potential U.S. tariffs.

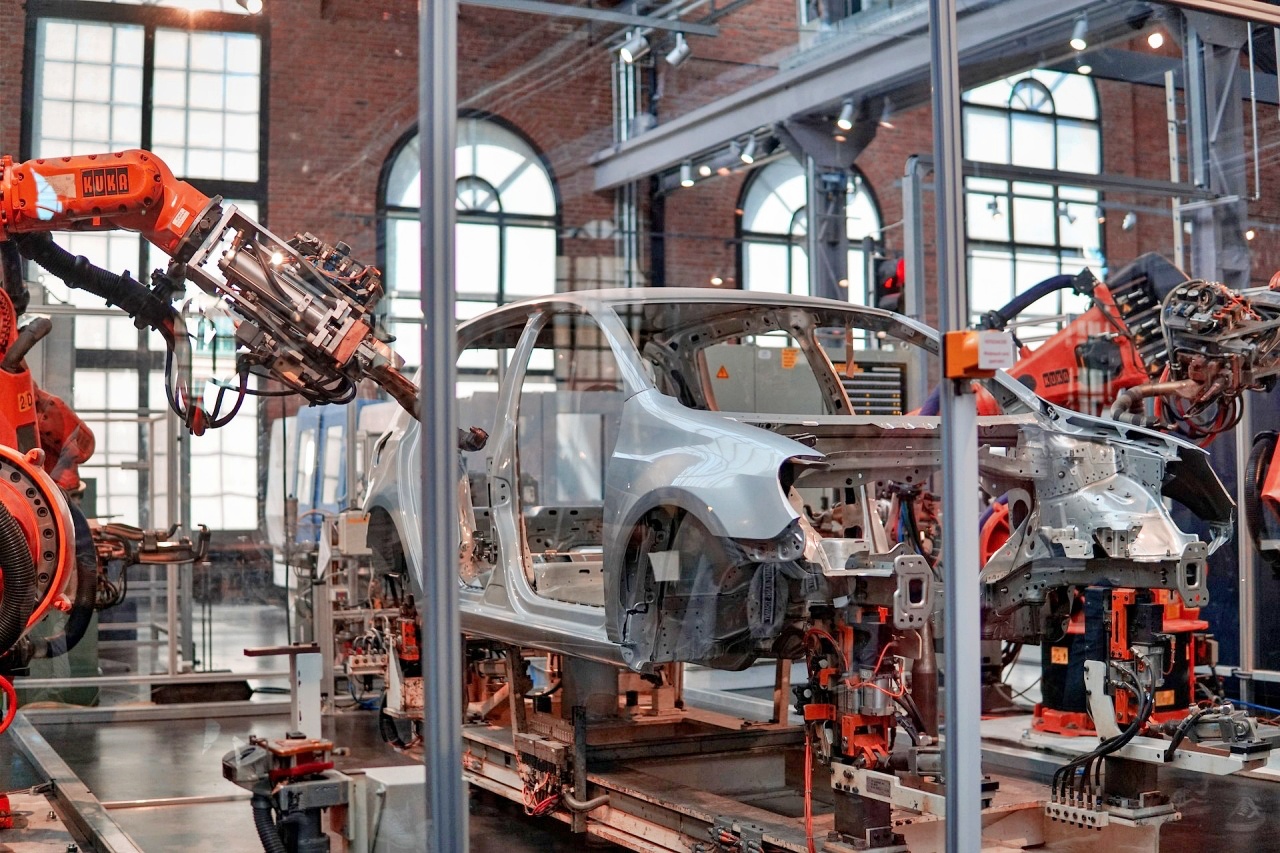

Since the U.S.-China trade war began in 2018, Vietnam has attracted foreign investment as companies seek alternatives to China. Major firms, including Samsung, Foxconn, Apple, Intel, and Nike, have expanded manufacturing operations there, strengthening Vietnam’s role in global supply chains. According to Vietnamese customs data, 29% of the nation’s exports now go to the U.S.

Vietnam exported $142.4 billion worth of goods to the U.S. last year, ranking sixth among America’s top suppliers after Mexico, China, Canada, Germany, and Japan. Despite exporting less than Mexico, its reliance on the U.S. market surpasses that of other trade partners, including China (2.5% of GDP) and Japan (3.7%).

However, this rapid export growth has created trade imbalances, making Vietnam a target for U.S. tariff scrutiny. It held the fourth-largest trade surplus with the U.S. in 2023, behind China, the EU, and Mexico. With a higher tariff rate than the U.S., VAT levies, and non-trade barriers, Vietnam meets key criteria for tariff application under White House policies. Additionally, the country remains on the U.S. watchlist for potential currency manipulation.

As U.S. officials prepare global reciprocal tariff measures by April, Vietnam’s heavy dependence on American trade poses a significant economic risk. The potential impact of new tariffs could disrupt its booming export-driven economy, affecting both local industries and multinational corporations relying on Vietnam as a key manufacturing hub.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran