May 07, 2019 04:07 am UTC| Commentary Central Banks

Reserve Bank of Australia (RBA) will announce its monetary policy decisions today at 4:30 GMT. Economy at a glance The economy is growing at 2.3 percent y/y as of Q4 2018 compared to 4.3 percent in early 2012....

On rate-cut Tuesday, here are four reasons why the Reserve Bank shouldn't jump

May 07, 2019 03:08 am UTC| Insights & Views Central Banks

Every first Tuesday of every month but January the Reserve Bank Board meets to decide whether to adjust interest rates. It announces its decision at 2.30 pm eastern time. It ought to be an easy decision. Officially, the...

FxWirePro: NOK vulnerable on falling oil prices – Call check on EUR/NOK/USD options triangle

May 06, 2019 13:42 pm UTC| Research & Analysis Central Banks

TheNOKcontinued to weaken last week, and theEURNOKhas traded back above the 9.80-handle going into this week, after trading as low (strong) as 9.55 two weeks ago. The main reason for the NOK weakness last week was...

FxWirePro: AUD/USD/JPY put switches and AUD/USD shorts in spot on RBA rate cut hopes

May 06, 2019 08:52 am UTC| Research & Analysis Central Banks

The canter of attraction is that the Antipodeans heading into early May, with both central banks in play on consecutive days on 7/8 May. The AUD short is well-placed now that we have brought forward our projection for two...

Fed Hike aftermath Series: Hike probabilities over coming meetings

May 06, 2019 07:54 am UTC| Commentary Central Banks

FOMC followed through its promise and hiked rates four times in 2018 and forecasted two more rate hikes for 2019. Current Federal funds rate - 225-250 bps (Note, all calculations are based on data as of 6th May) June...

May 06, 2019 06:48 am UTC| Research & Analysis Central Banks

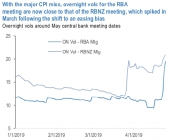

The Reserve Bank of Australias monetary policy is scheduled for this week (on April 2nd). Unusually, this meeting will be on the same day as the announcement of the Federal Budget at 7:30 pm that evening. As such, we would...

May 06, 2019 06:44 am UTC| Commentary Central Banks Economy

The Norges Bank is not expected to adopt any changes in the policy rate at the upcoming monetary policy meeting on May 9, but may update its earlier guidance on a rate hike within six months of March this year, according...

- Market Data