FxWirePro: The Day Ahead- 25th April 2019

Apr 25, 2019 03:57 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today, and some with high volatility risks associated. Data released so far: Japan: Bank of Japan (BoJ) kept the monetary policy rate unchanged at -0.1 percent....

Apr 24, 2019 14:09 pm UTC| Commentary Central Banks

Bank of Japan (BOJ) will announce its monetary policy decisions tomorrow sometime in early Asian hours, probably around 2:00 GMT, followed by a press conference from governor Kuroda around 6:30 GMT. Current monetary...

Bank of Canada monetary policy preview

Apr 24, 2019 13:34 pm UTC| Commentary Central Banks

Today, the Bank of Canada (BoC) is to provide further guidance in policy meet. The result of the monetary policy meeting is scheduled to be announced at 14:00 GMT. The press conference is scheduled at 14:15 GMT. Current...

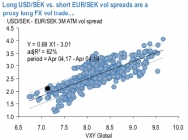

FxWirePro: Spotlight on relative value trades in Scandis

Apr 24, 2019 11:21 am UTC| Research & Analysis Central Banks

Long USDSEK vs short EURSEK vol spreads is a carry friendly way of owning FX vol from multi-year lows. Owning USD vol over cross-vol has almost always acted as a proxy bullish vol stance owning to the greater risk beta...

FxWirePro: How do Yen vols behave on BoJ’s event?

Apr 24, 2019 09:44 am UTC| Research & Analysis Central Banks

This week, major central banks (BoJ and BoC) are centre of attraction as they are scheduled for their monetary policies, on Wednesday, and there is a higher-than-usual degree of uncertainty. BoJ is most likely to maintain...

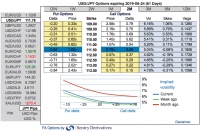

FxWirePro: USD/JPY hedging perspectives ahead of BoJ

Apr 24, 2019 09:36 am UTC| Research & Analysis Central Banks Insights & Views

This week, major central banks (BoJ and BoC) are centre of attraction as they are scheduled for their monetary policies, on Wednesday, and there is a higher-than-usual degree of uncertainty. BoJ is most likely to maintain...

Apr 24, 2019 08:29 am UTC| Commentary Central Banks Economy

The Reserve Bank of Australia (RBA) is expected to cut the benchmark cash rate by 25 basis points at its monetary policy meeting in May, with another 25 bps cut likely to follow in August, according to the latest report...

- Market Data