FxWirePro: RBA’s status quo trims Aussie gains - AUDNZD FX Derivatives Trade Perspectives

Apr 02, 2019 05:51 am UTC| Research & Analysis Central Banks

AUDNZD reversed sharply after the RBNZ last week and now targets 1.04 multi-week. The RBA today maintained a neutral stance keeping cash rates at 1.50%, which contrasts with the RBNZs easing bias and puts a heavy lid on...

Apr 02, 2019 05:34 am UTC| Commentary Central Banks Economy

The Reserve Bank of India (RBI) is expected to lower its policy rate by another 25 basis points at its monetary policy meeting on Thursday afternoon to prop up Indias economic growth, after unexpectedly delivering a 25 bp...

Apr 02, 2019 03:02 am UTC| Commentary Central Banks

Reserve Bank of Australia (RBA) will announce its monetary policy decisions today at 3:30 GMT. Economy at a glance The economy is growing at 2.3 percent y/y as of Q4 2018 compared to 4.3 percent in early 2012....

FxWirePro: Take a Look at Rates Derivatives Ahead of RBA

Apr 01, 2019 11:37 am UTC| Central Banks

Australias central bank is scheduled for monetary policy this week. The minutes of the RBA board meeting in March made it clear that the RBA requires more data to resolve discrepancies between growth and labor market...

Fundamentals to watch out for this week

Apr 01, 2019 11:23 am UTC| Commentary Central Banks

In terms of volatility risks, this week is heavy with the focus on Brexit, and U.S. economic data, What to watch for over the coming days: Central Banks: Reserve Bank of Australia (RBA) will announce...

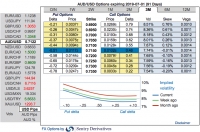

FxWirePro: AUD/USD OTC Outlook and Hedging Perspectives Ahead of RBA

Apr 01, 2019 10:55 am UTC| Research & Analysis Central Banks

Today, a busy start to a busy week of data and events in Australia saw the release of news concerning business sentiment, Caixin manufacturing PMIs and on the prices of both general consumer purchases and homes. Looking...

Apr 01, 2019 08:31 am UTC| Research & Analysis Central Banks

Aussie dollar is cushioned to its major downtrend on two important factors. Namely, first, RBA monetary policy and Caixin manufacturing PMIs. The Reserve Bank of Australias monetary policy is scheduled for this week (on...

- Market Data