Feb 28, 2019 09:07 am UTC| Commentary Central Banks Economy

The National Bank of Poland (NBP) is not expected to adopt any tightening in its monetary policy over the coming year, owing to a below-target inflation level in the economy, according to the latest research report from...

FxWirePro: The Day Ahead- 28th February 2019

Feb 28, 2019 05:49 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today, and some with high volatility risks associated. Upcoming: New Zealand: ANZ activity outlook index up 10.5 percent in January. United Kingdom: GFK consumer...

FxWirePro: The Day Ahead- 27th February 2019

Feb 27, 2019 06:19 am UTC| Commentary Central Banks

Not many economic data and events scheduled for today, and some with high volatility risks associated. Upcoming: United Kingdom: BRC shop price index up 0.7 percent y/y in February. Australia:...

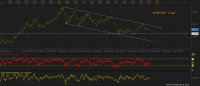

FxWirePro: ECB likely to push euro lower with dovish rhetoric

Feb 26, 2019 10:54 am UTC| Commentary Central Banks

Lower euro makes sense for Eurozone and we expect the European Central Bank (ECB) to act on it. At this point, a weaker euro against USD and the majority of its trading counterparts seem more sensible, as Eurozones...

FxWirePro: The Day Ahead- 26th February 2019

Feb 26, 2019 05:58 am UTC| Commentary Central Banks

Not many economic data and events scheduled for today, and some with high volatility risks associated. Upcoming: Germany: GFK consumer confidence report will be released today at 7:00 GMT. France: February...

Fundamentals to watch out for this week

Feb 25, 2019 14:21 pm UTC| Commentary Central Banks

In terms of volatility risks, this week is extremely heavy with the focus on Brexit, key economic data, trade talks, and central bankers, What to watch for over the coming days: Central Banks: Fed chair Powell...

FxWirePro: How Does Interest Rate Derivatives Look Like After January FOMC Minutes?

Feb 25, 2019 12:40 pm UTC| Research & Analysis Insights & Views Central Banks

The US markets came back to life following the release of the January FOMC minutes, and OIS briefly softened its inversion into early December. 2019s rebound in risky assets has left the risks around LDI hedgers roughly...

- Market Data