FxWirePro: EUR put/PLN call/RUB call OT spreads on hawkish NBP and crude’s uptrend

Jan 25, 2018 14:18 pm UTC| Research & Analysis Central Banks Insights & Views

There are three reasons pointing towards a weaker zloty over the coming years: first of all, growth would slow down in the H22018 following a boom period. Secondly, the political event risks (in particular as a result of...

Malaysian central bank hikes interest rate by 25 bps, likely to hike again in September

Jan 25, 2018 13:04 pm UTC| Commentary Central Banks

Malaysian central bank, Bank Negara Malaysia, hiked its overnight policy rate today as expected. The BNM rose the rates by 25 basis points to 3.25 percent, reiterating its projection that the currently strong and...

FxWirePro: What to expect from ECB ahead?

Jan 25, 2018 12:13 pm UTC| Commentary Central Banks

Today European Central Bank (ECB) is to provide further guidance in policy meet. Result to be announced at 12:45 GMT, followed by the press conference at 13:30 GMT. The meeting is to be held in Frankfurt,...

Jan 25, 2018 09:05 am UTC| Central Banks Research & Analysis Insights & Views

When pondering about the ECBs monetary policy meeting today, a proverb strikes our mind: if the mountain wont come to Mohammed. This seems to be exactly ECB President Mario Draghis approach. Despite weeks and weeks of...

FxWirePro: How does dollar look when all eyes on ECB and Davos? Snippets of FX options space

Jan 25, 2018 08:08 am UTC| Central Banks Research & Analysis Insights & Views

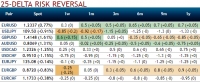

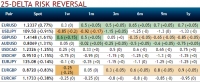

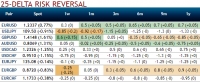

When all eyes are focussed on ECBs monetary policy today that may send hints of wrapping up of easing program and Switzerland at present, as a number of important heads of government are going to address the World Economic...

FxWirePro: Bid EUR/USD 1w/1m RRs to finance reverse collar spread for hedging ahead of ECB

Jan 25, 2018 06:48 am UTC| Research & Analysis Insights & Views Central Banks

The extrapolation of EURUSD levels of 1.24 indicates that the euro is seen as an attractive alternative to the US dollar by the market. But in this context let us refer to Thursdays ECB meeting. Even if the trade-weighted...

FxWirePro: Bid EUR/USD 1w/1m RRs to finance reverse collar spread for hedging ahead of ECB

Jan 25, 2018 06:48 am UTC| Research & Analysis Insights & Views Central Banks

The extrapolation of EURUSD levels of 1.24 indicates that the euro is seen as an attractive alternative to the US dollar by the market. But in this context let us refer to Thursdays ECB meeting. Even if the trade-weighted...

- Market Data