FED Hike Aftermath Series: Take note of Evans, a dove on the change

Mar 23, 2016 12:48 pm UTC| Central Banks Commentary

Two rate increases not at all unreasonable When such comments come from the most dovish of FED policymakers, it calls for caution. Chicago FED president Charles Evans, last year has been strongly calling for no hikes,...

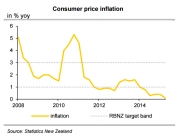

Downside risks to New Zealand inflation outlook likely to keep RBNZ under pressure

Mar 23, 2016 11:25 am UTC| Central Banks

New Zealands economy expanded more than expected in the fourth quarter of 2015, but the tepid inflation picture suggests more rate cuts from the central bank. New Zealands GDP rose a seasonally adjusted 0.9 percent in Q4...

FED hike aftermath series: Dollar well bid as market sharply fast forwards hike expectations

Mar 23, 2016 09:30 am UTC| Commentary Central Banks

For the past three days, Dollar has gained against its developed as well as emerging market currencies. After US Federal Reserve policymakers in its March meeting reduced rate expectations by 50 basis points to just two...

Thai Baht falls against US dollar after BoT stands pat

Mar 23, 2016 08:06 am UTC| Central Banks

USD/THB is trading around 35.09 levels. It made intraday high at 35.11 and low at 34.94 levels. Thailand central bank keeps policy rate unchanged at 1.50 pct as expected. Intraday bias remains bullish till...

FED Hike Aftermath Series: What to infer from rising inflation expectations?

Mar 23, 2016 07:31 am UTC| Commentary Central Banks

Breakeven inflation rates in United States and around the world are rising, with partial thanks to higher oil price. However, there is probably more to infer from this rising expectations rather than just to consider it as...

RBA likely to hold policy over next two quarters as real estate still poses risks

Mar 22, 2016 08:26 am UTC| Commentary Central Banks

Since mid-last year, Reserve Bank of Australia, refrained from cutting rates below 2% and one of the key reason it cited was lower rates, helping fuel speculations in Australias property markets. With regulators, RBA took...

BOJ offers dollar supply operation for 3/24 - 3/31 (EST)

Mar 22, 2016 01:41 am UTC| Central Banks

Amount of BOJs dollar supply operation is unlimited within the amount of pooled eligible...

- Market Data