German government bunds jump after Merkel fails to secure outright majority

Sep 25, 2017 11:41 am UTC| Commentary Economy

The German government bunds jumped Monday after investors moved towards safe-haven assets, following the German election results, which overcast a shadow of doubt as Chancellor Angela Merkel failed to secure an outright...

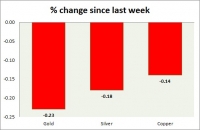

Commodities snapshot (precious & industrial)

Sep 25, 2017 11:15 am UTC| Commentary

The metal pack is down today. Performance this week at a glance in chart table - Gold: Gold is grinding lower as the dollar recovers. Todays range $1288-1298 Gold might decline towards $1258 per troy...

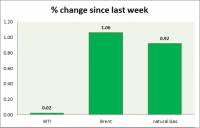

Sep 25, 2017 11:11 am UTC| Commentary

Energy pack is up in todays trading. Weekly performance at a glance in chart table, Oil (WTI) WTI is consolidating above $50 per barrel. Todays range $50.4 -51 Active call Buy targeting $56 per barrel WTI...

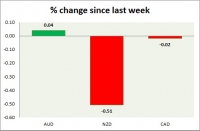

Currency snapshot (commodity pairs)

Sep 25, 2017 11:06 am UTC| Commentary

Dollar index trading at 92.52 (+0.20%) Strength meter (today so far) Aussie +0.04%, Kiwi -0.51%, Loonie -0.02% Strength meter (since last week) Aussie +0.04%, Kiwi -0.51%, Loonie -0.02% AUD/USD Trading at...

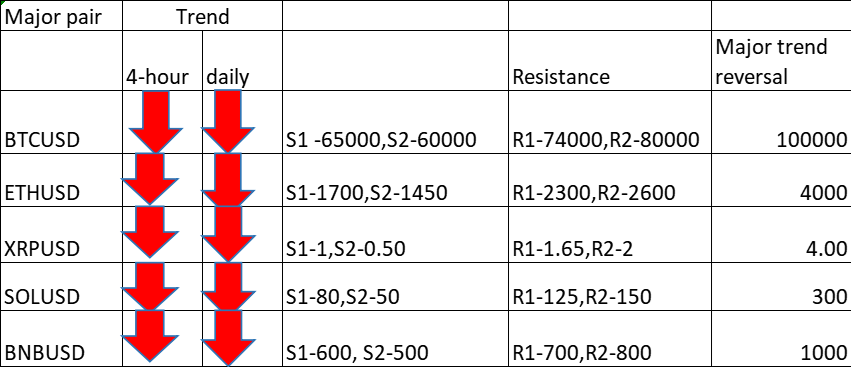

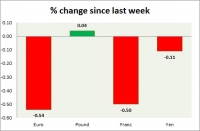

Currency snapshot (major pairs)

Sep 25, 2017 11:00 am UTC| Commentary

Dollar index trading at 92.47 (+0.15%) Strength meter (today so far) Euro -0.54%, Franc -0.50%, Yen -0.11%, GBP +0.04% Strength meter (since last week) Euro -0.54%, Franc -0.50%, Yen -0.11%, GBP +0.04% EUR/USD...

Fundamentals to watch out for this week

Sep 25, 2017 10:32 am UTC| Commentary Central Banks

This week is a quite heavy with volatility risks, especially in terms of events. What to watch for over the coming days: Central banks: Bank of Japan (BoJ) governor Kuroda is scheduled to speak on Monday and...

Latest Commitment of Traders positions (FX) as at September 19th 2017

Sep 25, 2017 10:10 am UTC| Commentary

CFTC commitment of traders report was released on Friday (22nd September) and cover positions up to Tuesday (19th September). COT report is not a complete presenter of entire market positions since the future market is...

- Market Data