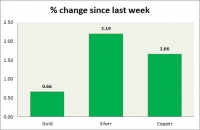

Commodities snapshot (precious & industrial)

Jul 13, 2017 12:05 pm UTC| Commentary

The metal pack is mixed today. Performance this week at a glance in chart table - Gold: Gold is marginally recovering as the dollar declines. The focus is on Yellen testimony. Todays range $1224-1216 In the...

Jul 13, 2017 12:01 pm UTC| Commentary

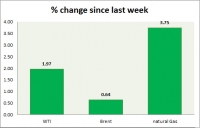

Energy pack is down in todays trading. Weekly performance at a glance in chart table, Oil (WTI) Oil price recovery spoiled last night and oil has resumed its decline. Todays range $45.6-44.9 Active call add...

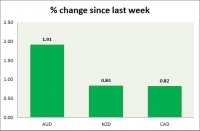

Currency snapshot (commodity pairs)

Jul 13, 2017 11:58 am UTC| Commentary

Dollar index trading at 95.75 (-0.01%) Strength meter (today so far) Aussie +0.60%, Kiwi +1.04%, Loonie -0.04% Strength meter (since last week) Aussie +1.91%, Kiwi +0.83%, Loonie +0.82% AUD/USD Trading at...

FxWirePro Call review: Maintain short positions in oil

Jul 13, 2017 11:28 am UTC| Commentary

Oil s bounce back on the back of a large inventory draw according to API inventory report and on the back of a news of final fuel shortage in Europe despite large draw by refineries spoiled last night as the oil price...

FxWirePro Call Review: Maintain long positions in EUR/CHF

Jul 13, 2017 10:29 am UTC| Commentary

In a mid-June this year, we recommended to our readers to long on the euro against the franc at the then current rate of 1.089 in an article named, FxWirePro: Buy euro against franc targeting 1.12, available at...

Oil in Global Economy Series: OPEC June deal compliance review

Jul 13, 2017 09:19 am UTC| Commentary

In November last year, when OPEC members agreed to cut production for the first time since the Great Recession, it was welcomed with great optimism and oil price jumped more than 20 percent, from $45 per barrel to as high...

FxWirePro Call Review: Interim target reached in USD/CHF; partial profit bookings recommended

Jul 13, 2017 09:02 am UTC| Commentary

In January this year, in an article named, FxWirePro: Swiss franc might correct to 0.98, bearish outlook maintained, available at http://www.econotimes.com/ , we warned our readers while we remain bullish on the dollar...

- Market Data