Fed’s LMCI pauses in September as labor market improvement moderates

Oct 05, 2015 15:25 pm UTC| Commentary

The Federal Reserves Labor Market Conditions Index (LMCI) was unchanged in September, suggesting US labor market improvement slowed to a halt last month. This mornings release incorporates data from last Fridays September...

US ISM nonmanufacturing index shows more moderate pace of service sector growth

Oct 05, 2015 15:20 pm UTC| Commentary

The ISM nonmanufacturing index declined to 56.9 in September (previous: 59.0), modestly below our and consensus expectations for a reading of 57.5. Despite the larger-than-expected fall in the headline index, the details...

U.K. PMIs confirm moderate growth rate

Oct 05, 2015 12:13 pm UTC| Commentary

The September Services headline PMI of U.K. continued its decline, by 2.7 points to 53.3, significantly lower than expectation. On a quarterly basis, the Q3 average declined 2.7pp to 55.4 from the Q2 average. The...

Mexico's consumer confidence index likely to move back

Oct 05, 2015 12:05 pm UTC| Commentary

Mexicos consumer confidence index for September is scheduled to release tomorrow. After a surprise uptick in June, consumer confidence index of Mexico struggled to gain ground in July and August. This appears to be a...

Brazil's inflation acceleration probably over in this cycle

Oct 05, 2015 11:59 am UTC| Commentary

Brazils inflation data released for mid-September suggest that inflation acceleration in the country is nearly over. Therefore, a mild easing in pace is expected in September (SGe: 9.45% yoy) and Q4. The bulk of the...

US import prices likely remained on a downtrend in September

Oct 05, 2015 09:47 am UTC| Commentary

In US, available data suggest that imported oil costs fell by 5.1% during the reference period, knocking six ticks off the headline measure last month. x Softer petroleum quotes, combined with projected reductions in...

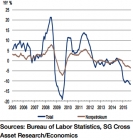

US consumer credit probably reaccelerated in August

Oct 05, 2015 09:44 am UTC| Commentary

Data released by the Federal Reserve Board on assets and liabilities at commercial banks imply that revolving liabilities rose by $4.8 billion during the reference period, a touch above the $4.3-billion increase recorded...

- Market Data