ECB to contend with risks of unwarranted tightening stance

Sep 24, 2015 04:53 am UTC| Commentary

Last week, board member Curé described the 4% appreciation since the summer as "fairly significant", showing the sensitivity to the euro in a context of low inflation and dovish central banks. For now, the risks of...

ECB to keep eye on fragmentation and credit growth

Sep 24, 2015 04:44 am UTC| Commentary

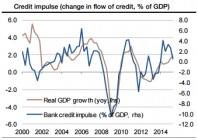

While the net take-up of the ECBs TLTRO programme has been broadly in line with the expectations, the recovery in bank lending (and business investment) remains lacklustre. Looking at the flow of credit, the credit impulse...

Daily Economic Outlook: 24th September, 2015

Sep 24, 2015 04:17 am UTC| Commentary

Following yesterdays mixed September PMI figures from China and the euro area, this morning will see markets paying specific attention to Germanys IFO business sentiment index. The headline measure, which has traditionally...

Mexico's economy likely to decelerate in Q3

Sep 24, 2015 04:04 am UTC| Commentary

Mexicos retail sales increased 0.5% m/m sa in July as a result of the expansion in food, hardware and apparel sales partially offset by lower supermarket, domestic equipment and paper and entertainment sales. In annual...

Extension likely for ECB's asset purchases

Sep 24, 2015 03:39 am UTC| Commentary

The euro area is likely to show resilience in the short term, helped by robust consumption (due to stronger real disposable incomes and improving labour markets) and continued recovery in exports to the US."Only in early...

Fed and China not necessarily a signal for ECB to do more

Sep 24, 2015 03:34 am UTC| Commentary

ECB president Draghi has gone to great lengths to explain that there is ample room for the ECB to adjust the "size, composition and duration" of its asset purchases. Many have taken this as a signal that more ECB action is...

Reasons why Mexico's FX commission will keep intervention parameters unchanged

Sep 24, 2015 03:31 am UTC| Commentary

Under Mexicos current market conditions, the FX commission will keep the amount and parameters of its passive FX interventions unchanged next September 30.According to Barclays the resaons are: MXN is far from cheap and...

- Market Data