China’s dimmer growth outlook not fully priced

Sep 23, 2015 04:51 am UTC| Commentary

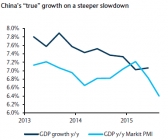

The implications of Chinas dimmer growth outlook is likely to be fully priced into risky assets globally, particularly in EM. China growth forecasts for 2015 and 2016 has been cut to 6.6% and 6.0%, from 6.8% and 6.6%,...

Extended ZAR weakness likely over coming quarters

Sep 23, 2015 04:45 am UTC| Commentary

The SARB is not expected to defend the exchange rate mainly because of the countrys relatively low levels of FX reserves. The fact that there has been a relatively limited FX pass-through into the inflation data also...

Recent China developments created opportunities in FX markets

Sep 23, 2015 04:41 am UTC| Commentary

Chinas recent FX measures have given markets a feast for thought and created new opportunities in FX markets as year-end approaches. There is still a lively debate about what the August 11 measures, and the FX...

Vulnerabilities offset recent cheapening of TRY

Sep 23, 2015 04:31 am UTC| Commentary

Breakevens have widened more than 100bp even though real rates have risen alongside TRY move. Moreover, CBT may choose to tolerate TRY weakness in line with broader EM FX moves, rather than being proactive. Despite TRYs...

Fiscal risks and weak growth add pressure on BRL

Sep 23, 2015 04:22 am UTC| Commentary Economy

Little reason is seen to believe that BRL depreciating trend is over. Brazil economic activity continues to collapse and political commitment to push forth the necessary structural reforms remains lacking. As such,...

Daily Economic Outlook: 23rd September, 2015

Sep 23, 2015 04:18 am UTC| Commentary

As speculation mounts that the ECB may be leaning towards an expansion of its QE programme, markets will focus on this mornings preliminary eurozone PMI reports and President Draghis appearance at the European Parliaments...

Recent China developments likely created opportunities in FX markets

Sep 23, 2015 03:55 am UTC| Commentary

Chinas recent FX measures have given markets a feast for thought and created new opportunities in FX markets as year-end approaches. There is still a lively debate about what the August 11 measures, and the FX...

- Market Data