Daily Economic Outlook: 3rd August, 2015

Aug 03, 2015 04:14 am UTC| Commentary

This morning will see the release of July manufacturing PMI data across much of Europe. The flash reading for the euro area as a whole fell modestly from its June level, reflecting slippages in both France and Germany. The...

US motor vehicle purchases likely to rebound in July

Aug 03, 2015 04:12 am UTC| Commentary

Buoyed by tightening labor market conditions, motor vehicle purchases probably rebounded by 2.3% to a seasonally adjusted annual rate of 17.5 million in July, the strongest performance for that month since the...

US construction spending likely quickened in June

Aug 03, 2015 04:09 am UTC| Commentary

Powered by a sharp acceleration in home-building activity, the nominal value of new construction put-in-place probably jumped by 1.6% in June, double the percentage rise posted in the previous month."Private residential...

Euro area inflation outlook remains benign

Aug 03, 2015 04:00 am UTC| Commentary

The IMF is unwilling to support a new bailout program unless Greeces debt was deemed to be sustainable in the medium term and it had a fully financed budget for the next 12 months.Although near-term risks of an exit have...

US employment report to be next key focus

Aug 03, 2015 03:52 am UTC| Commentary

As the Fed continues in its data-dependent mode, the employment report is crucial. The Fed and markets will have only two more job reports to assess the likelihood of a September lift-off.The last ECI print confirmed that...

German Q2 GDP growth expected at 0.5% qoq

Aug 03, 2015 02:26 am UTC| Commentary

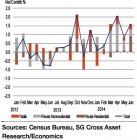

German GDP is expected to have risen by 0.5% qoq in Q2, up from the weaker-than-expected 0.3% in Q1, on the back of robust domestic demand. While both stocks and net exports contributed negatively in Q1, the underlying...

Final German HICP inflation to confirm flash estimates at 0.1% yoy

Aug 03, 2015 01:43 am UTC| Commentary

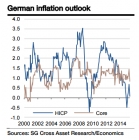

Flash German HICP inflation remained stable at 0.1% yoy in July. The national measure softened from 0.3% yoy in June to 0.2% yoy in July. As for the components, both energy and food declined, thus pushing inflation lower...

- Market Data