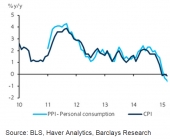

Personal consumption PPI suggests a moderation in downward pressures for US CPI

Jun 12, 2015 14:26 pm UTC| Commentary

Producer prices rose 0.5% m/m in May, stronger than consensus (0.4%) forecasts. The rise in headline PPI was driven by a 5.9% m/m increase in energy prices. Core PPI (ex-food and energy) rose a more modest 0.1% m/m...

Russia CBR to continue cutting, but at a slower pace

Jun 12, 2015 10:38 am UTC| Commentary

The Bank of Russia (CBR) is likely to cut its key rate 100bp to 11.5% at its meeting on Monday 15 June. This is a slower rate than the 150bp cut at its May meeting. The CBR is in slightly less of a hurry to cut rates at...

Sharp drop of the cotton production in India and China expected

Jun 12, 2015 10:10 am UTC| Commentary

The cotton price shed 2% yesterday on the back of generally weak commodity prices. The estimates of the US Department of Agriculture (USDA) published on Wednesday showed no changes to the figures for US cotton supply and...

IEA revises demand forecasts significantly upwards

Jun 12, 2015 09:48 am UTC| Commentary

The Brent price dipped below the $65 per barrel mark yesterday, while WTI is now trading only just over $60 per barrel. Oil prices are thus failing to profit from the fact that the International Energy Agency revised the...

May data point to stabilization; PBoC reiterates commitment to CNY internalization

Jun 12, 2015 07:45 am UTC| Commentary

The remaining set of Chinese data for May released yesterday merely pointed to stabilization of the economy at best. There were few signs of a rebound as yet and suggest that monetary conditions are likely to remain...

Hawkish tone in COPOM minutes supports BRL rally

Jun 12, 2015 07:38 am UTC| Commentary

The Brazilian real appreciated almost 1% vs. the USD to USD-BRL 3.09 on Thursday. Expectations of the central bank keeping a hawkish stance as shown in the latest COPOM minutes fueled yesterdays BRL rally. This document...

Canada's external imbalance worsens

Jun 12, 2015 07:15 am UTC| Commentary

Canadas sizeable deficit is a lingering issue that has underpinned the bearishness on CAD ever since the imbalance became decreasingly funded by "long-term" capital flows-such as bonds-in recent years.One of the many...

- Market Data