Fundamental Evaluation Series: USDJPY vs. 2-year yield spread

Jan 31, 2019 12:48 pm UTC| Commentary

The above chart shows the relation between the 2-year bond spread (U.S. - Japan) and USD/JPY exchange rate. Brief background (2012-2016): This one pair has been at odds with yield divergence throughout early 2016 as...

Australian private sector credit growth decelerates in December

Jan 31, 2019 11:40 am UTC| Commentary

Australian private sector credit growth decelerated more than anticipated in December. Total private sector credit growth eased to 0.2 percent sequentially from Novembers 0.3 percent. On a year-on-year basis, the growth...

German bunds remain mixed after unemployment change data disappoints in January

Jan 31, 2019 10:26 am UTC| Commentary Economy

The German bunds remained mixed after the countrys unemployment change for the month of January disappointed market sentiments, while Eurozones jobless rate remained unchanged during the month of December. The German...

Fundamental Evaluation Series: 2-year yield spread vs. GBP/USD

Jan 31, 2019 09:17 am UTC| Commentary

The chart above shows, how the relationship between GBP/USD and 2-year yield divergence has unfolded since 2012. The chart clearly shows the close relationship between yield spread and the exchange rate. Since June...

Fundamental Evaluation Series: EUR/USD vs. 2-year yield spread

Jan 31, 2019 09:11 am UTC| Commentary

The chart above shows, how the relationship between EUR/USD and 2-year yield spread (U.S. - Eurozone) has unfolded since 2012. It is evident that these short rates have been a key influencing factor for the pair as policy...

USD/INR likely to consolidate between 70-72 for now, says Commerzbank

Jan 31, 2019 08:38 am UTC| Commentary Economy

The USD/INR currency pair is expected to consolidate between a range of 70-72 for now, as it holds around the 71.10 level currently, according to the latest research report from Commerzbank. The federal election is just...

Jan 31, 2019 07:44 am UTC| Commentary Economy

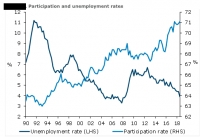

New Zealands unemployment rate is expected to see a small bounce from 3.9 percent to 4.1 percent in the fourth quarter of 2018, after last quarters very large, unexpected drop of 0.5 percentage point, according to the...

- Market Data