U.S. Treasuries flat ahead of manufacturing PMI, ADP non-farm employment

Jul 31, 2017 11:51 am UTC| Commentary Economy

The U.S. Treasuries remained flat as investors wait to watch the countrys manufacturing PMI, scheduled to be released on August 1 amid a silent session that witnessed data of little economic significance. Also, the ADP...

UK gilts gain ahead of 10-year auction, July construction PMI

Jul 31, 2017 10:07 am UTC| Commentary Economy

The UK gilts gained Monday as investors wait to watch the 10-year auction, scheduled to be held on August 1 and the countrys construction PMI, for the month of July, due on August 2, will provide further direction to the...

Eurozone periphery bonds trade mixed after July CPI meets expectations, jobless rate cheers markets

Jul 31, 2017 09:22 am UTC| Commentary Economy

The Eurozone periphery bonds traded mixed Monday after the regions consumer price-led inflation index (CPI) for the month of July met market expectations and the rate of unemployment cheered investors, dropping from the...

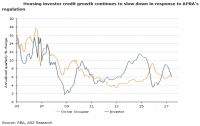

Australian housing investor credit continues to ease, led by business sector revival: ANZ Research

Jul 31, 2017 08:13 am UTC| Commentary Economy

Australian private sector credit recorded a solid increase in June, led by a rebound in the business sector after several months of weakness. The divergence between the investors and owner-occupier housing credit...

Jul 31, 2017 06:42 am UTC| Commentary Economy

The EUR/USD currency pair is expected to hit a high of around 1.21 in late 2017 before easing moderately in 2018 as inflation in the euro area remains low. The shift in the ECBs forward guidance in June and the...

New Zealand bonds close flat ahead of GDT price auction, Q2 employment report

Jul 31, 2017 05:55 am UTC| Commentary Economy

The New Zealand bonds ended flat Monday as investors wait to watch the countrys GlobalDairyTrade price auction, scheduled to be held on August 1. Also, the second-quarter employment report, due on the same day at 22:45GMT...

JGBs flat after industrial production rebounds; investors await 10-year auction

Jul 31, 2017 04:11 am UTC| Commentary Economy

The Japanese bonds remained flat at the start of the trading week Monday after the countrys industrial production, release later yesterday, rebounded during the month of June. Also, investors are waiting to watch the...

- Market Data