The ECB policy decision and UK retail sales are the highlights of the calendar, but attention will also be on the start of a two-day EU leaders summit (including PM Theresa May) in Brussels. Mrs. May is reportedly going to say that there will no second EU referendum on the UK’s withdrawal from the bloc. For UK retail sales, we look for a rise of 0.7% (including fuel) in September.

Nevertheless, the decision to leave the EU has yet to have a meaningful negative impact on the retail sales figures.

In terms of the ECB, no changes to policy are expected to be announced this month. Instead, the focus will be on potential signals of future policy changes from the press conference at 13:30BST with President Mario Draghi.

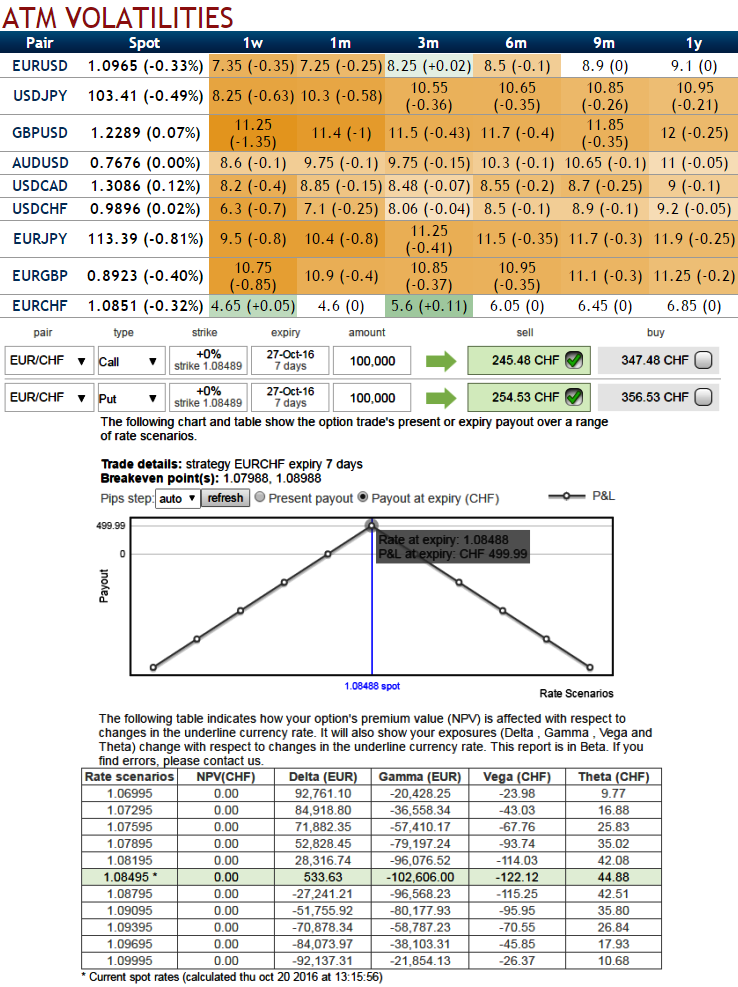

Expect certain returns on shorts of EURCHF straddles as long as spot EURCHF remains relatively range-bound in next one week time since we initiated this trade in expectation of post-policy meeting consolidation in the cross.

With a week to expiry, the trade is reasonably short delta, not something we are especially comfortable with ahead of an ECB meeting which we expect could prove reasonably inconclusive about the ECB’s policy intentions and so partially reverse the recent downward pressure on Euro crosses.

The OTC options market appeared to be more balanced on the direction for the pair over the 1w to 1m time horizon as hedgers have been cautious on long-term downtrend that has lasted since mid-April 2013 and as a result delta risk reversal for AUDUSD was turning into negative.

Lower IVs of ATM contracts have been lackluster and seems like huge disparity exists between option premiums and IVs as the 1W ATM puts have been priced excessively more than NPV which in turn a cause of concern as to whether spot FX would move in sync with risk reversals or not.

Delta risk reversals of EURCHF also indicate puts have been relatively costlier. As it showed the 3rd highest negative values which indicate downside risks of spot FX is anticipated and hedging for such risks is relatively more expensive. Hence, it is advisable to sell 1w 1.0850 straddles on EURCHF.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation