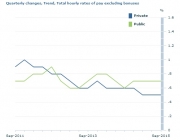

Wage growth in Australia lowest in 17 years

Nov 18, 2015 07:09 am UTC| Insights & Views

To add to the concern of Reserve Bank of Australia (RBA) is the latest wage report, which showed wage growth is at lowest level since 1998. In October, unemployment rate dropped by 0.3% to 5.9% and employment rose by...

Guide to today’s important data and events

Nov 18, 2015 05:33 am UTC| Insights & Views

Not many economic dockets scheduled for today and all with low to medium risks associated. Focus is on FOMC minutes Data released so far - Australia - Wages grew by 0.6% in third quarter, up 2.3% from a year...

An Islamic reformation is not the solution to stop extremism

Nov 18, 2015 01:02 am UTC| Insights & Views

Milad Milani, Lecturer, History and Political Thought, Western Sydney University There is a push to reform Islam, by arguably Western standards. But if Islamic reform is achieved, it will still not spell the end of...

Declaring war will not rid Europe of terror

Nov 18, 2015 00:49 am UTC| Insights & Views

Aurelien Mondon, Lecturer in French and Comparative Politics, University of Bath Francois Hollande has confirmed that the French government will take a hard stance in response to the attacks which took place in Paris on...

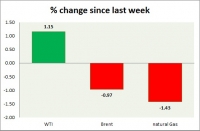

Nov 17, 2015 15:59 pm UTC| Insights & Views

Energy pack is up today over escalating violence in Middle East. Weekly performance at a glance in chart table. Oil (WTI) - WTI is giving up lot of its yesterdays gains as risk aversion over Middle East proved to...

Commodities snapshot (precious & industrial)

Nov 17, 2015 15:47 pm UTC| Insights & Views

Metal pack is down, in todays trading. Performance this week at a glance in chart table - Gold - Gold is in decline as risk aversion faded further. Todays range $1085-1074 Gold is currently trading at $1092/troy...

Nov 17, 2015 15:32 pm UTC| Insights & Views

Equities are all green in todays trading. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart table - SP 500 - SP 500...

- Market Data