FxWirePro: Stay firm with put ladders on NZD/JPY rallies

Oct 12, 2015 06:33 am UTC| Insights & Views

We maintain long term bearish trend stance, while short term upswings could also to be utilized by below strategy. In our opinion, although some price recoveries that weve been seeing from last couple of days, monthly...

Guide to today’s important data and events

Oct 12, 2015 06:27 am UTC| Insights & Views

Few economic dockets scheduled for today and all with low risks associated. Upcoming - France - Current account for August is to be released at 6:45 GMT. Prior reading -0.4 billion. Portugal - Consumer price index to...

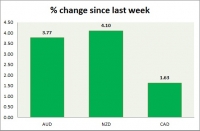

Currency snapshot (commodity pairs)

Oct 09, 2015 17:31 pm UTC| Insights & Views

Dollar index trading at 94.75 (-0.57%) Strength meter (today so far) - Aussie +0.85%, Kiwi +0.46%, Loonie +0.47%. Strength meter (since last week) - Aussie +3.77%, Kiwi +4.10%, Loonie +1.63%. AUD/USD - Trading at...

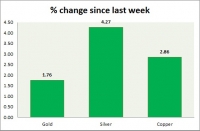

Commodities snapshot (precious & industrial)

Oct 09, 2015 17:25 pm UTC| Insights & Views

Metal pack is green in todays trading. Performance this week at a glance in chart table - Gold - Gold broke above key resistance around $1152 and headed higher. Todays range - $1138-$1159. Gold might reach as high as...

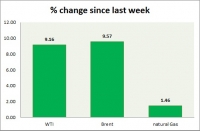

Oct 09, 2015 16:25 pm UTC| Insights & Views

Energy pack is trading in green today. Weekly performance at a glance in chart table. Oil (WTI) - WTI trimmed gains today from 200 day moving average line. Todays range $49.7-50.95 Active call - Buy WTI with...

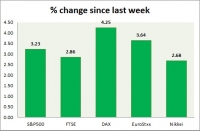

Oct 09, 2015 15:39 pm UTC| Insights & Views

Equities are all mixed today. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart table - SP 500 - SP 500 is marginally...

Currency snapshot (major pairs)

Oct 09, 2015 15:23 pm UTC| Insights & Views

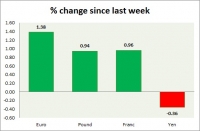

Dollar index trading at 95. 37 (-0.21%). Strength meter (today so far) - Euro +0.71%, Franc +0.51%, Yen -0.30%, GBP -0.23% Strength meter (since last week) - Euro +1.38%, Franc +0.96%, Yen -0.36%, GBP +0.94% EUR/USD...

- Market Data