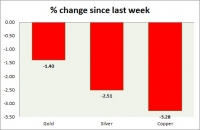

Commodities snapshot (precious & industrial)

Sep 22, 2015 15:02 pm UTC| Insights & Views

Metal pack is trading in red today. Performance this week at a glance in chart table - Gold - Gold is down today, as falling stocks failed to ignite safe haven buying into yellow metal. Todays range - $1121-$1136...

Sep 22, 2015 14:50 pm UTC| Insights & Views

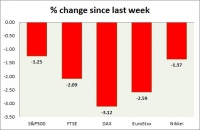

Equities are all trading in green today. Performance this week at a glance in chart table - SP 500 - SP 500 is down -2%, hit by risk aversion arising from global growth concern. Todays range 1976-1933. SP 500 future...

RBS joins dovish club over BOE rate hike as mining massacre continues across globe

Sep 22, 2015 14:24 pm UTC| Insights & Views

Royal Bank of Scotland joined the dovish club against Bank of England (BOE) rate hike after Citi last week pushed their expectations for rate hike further to end of next year and one hike in 2016, instead of previous...

Nervous market pushes Brazilian Real to new all-time low

Sep 22, 2015 13:01 pm UTC| Insights & Views

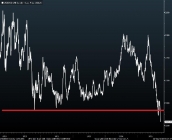

Markets nervousness over emerging markets is proving hard to be cured as currencies kept plunging despite US Federal Reserve kept rates on hold. Situation is worst for Brazil, whose currency has taken a dive to new...

Sep 22, 2015 12:30 pm UTC| Insights & Views

The US dollars strength is forecasted which we expect to appreciate by more than 5% in REER terms over the next 12 months even though the Fed delays its lift-off. On this stronger USD outlook, we also project the EUR to...

Traders bring down Zinc to lowest since 2010 worrying over China

Sep 22, 2015 12:28 pm UTC| Insights & Views

Traders are pushing metals to their lowest levels not seen since financial crisis. Base metal sector is taking heavy hit today as investors keep on shorting commodities. Red metal Copper, which is often seen as barometer...

Risk of a delay in BOE hiking cycle likely if Fed holds rates longer

Sep 22, 2015 11:20 am UTC| Insights & Views Central Banks

The U.S. central bank held fire on its first rates rise in more than nine years. A rate rise is not expected to happen until next year in the wake of a global stock market sell-off triggered by economic turmoil in China....

- Market Data