Ramifications of FOMC decision on treasury yields, PCE and other macros

Sep 18, 2015 10:17 am UTC| Insights & Views

In the repercussion of the much-awaited Feds meeting outcome fixed income trades with a better tone. US Treasuries are consolidating their post-meeting gains, fortified by both press conference comments by Fed Chair,...

FOMC rate decision – all about China, EM and noflation

Sep 18, 2015 10:16 am UTC| Insights & Views

Last night Federal Open Market Committee (FOMC) refrained from hiking rates by 25 basis as was anticipated by quite large portion of financial world. Economists and market participants were well divided. So what caused...

FxWirePro: Dollar loses gains vs sterling owing to FOMC, range persistence on table

Sep 18, 2015 10:06 am UTC| Insights & Views

Last nights much awaited FOMC rate decision to leave its policy rate target range unchanged at 0-0.25% will continue to resound around the markets. However, while market expectations were confirmed, a majority of FOMC...

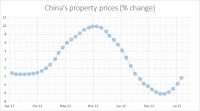

China’s property market – is worst over?

Sep 18, 2015 09:42 am UTC| Insights & Views

Is Chinas ravaged property market heading for a turnaround - it is quite difficult to say for sure standing at this points but further evidence from data suggests that decline is definitely slowing down even if improvement...

Guide to today’s important data and events

Sep 18, 2015 08:45 am UTC| Insights & Views

Not many economic dockets to be released today. All with low risks associated. Data released so far - China - House price index dropped -2.3% in August, after -3.7% drop in July. Euro Zone - Current account...

FxWirePro: Leading indicators trace out early signals of Loonie’s gain and trend reversal

Sep 18, 2015 07:33 am UTC| Insights & Views

After prolonged bull-run of USDCAD, now looking to reverse and change its direction. Technical charts with all timeframes are tracing out early signs of bearish sentiments. A hanging man pattern candle has formed on daily...

FxWirePro: GBP/JPY shorts on PRBS on job – long ATM puts yet to function

Sep 18, 2015 06:39 am UTC| Insights & Views

On monthly chart, the formation of hanging man pattern candle on peaks of uptrend at around 193.456 levels. This hanging man followed by two long real body red candles would reveal a medium term downtrend direction.Overall...

- Market Data