FxWirePro: Is it U turn on AUD/CAD? Stay firm with shorts on short put ladder

Sep 18, 2015 06:10 am UTC| Insights & Views

We had advocated short put ladder strategy in our earlier post, now short sides seem to function as per our expectations as the pair rallies onto 0.9519 levels, so that those shorts with smaller expiries, lets 3D, 5D or 7D...

Sep 17, 2015 17:18 pm UTC| Insights & Views

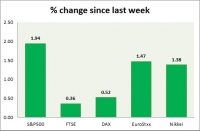

Equities are all mixed today. Performance this week at a glance in chart table - SP 500 - SP 500 is marginally up, hovering just below key psychological level of 2000. Todays range 1995-1973. Initial jobless...

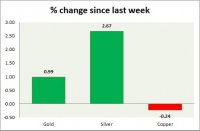

Commodities snapshot (precious & industrial)

Sep 17, 2015 16:50 pm UTC| Insights & Views

Metal pack is trading in low volatility today. Performance this week at a glance in chart table - Gold - Gold is marginally down after yesterdays gains from $1100 support area, focus on FOMC. Todays range -...

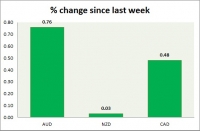

Currency snapshot (commodity pairs)

Sep 17, 2015 16:35 pm UTC| Insights & Views

Dollar index trading at 95.33 (+0.01%) Strength meter (today so far) - Aussie -0.74%, Kiwi -0.56%, Loonie -0.20%. Strength meter (since last week) - Aussie +0.76%, Kiwi +0.03%, Loonie +0.48%. AUD/USD - Trading at...

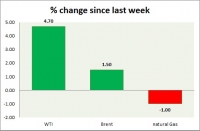

Sep 17, 2015 16:26 pm UTC| Insights & Views

Energy pack is trading in red today. Weekly performance at a glance in chart table. Oil (WTI) - WTI is marginally down heading into FOMC rate decision after yesterdays spectacular rise. Todays range $47.7-46.3. WTI...

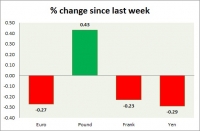

Currency snapshot (major pairs)

Sep 17, 2015 16:06 pm UTC| Insights & Views

Dollar index trading at 95.26 (-0.06%). Strength meter (today so far) - Euro +0.14%, Franc -0.10%, Yen -0.32%, GBP -0.02% Strength meter (since last week) - Euro -0.27%, Franc -0.23%, Yen -0.29%, GBP +0.43% EUR/USD...

FED rate hike: arguments against –weak EM/China

Sep 17, 2015 14:24 pm UTC| Insights & Views

FOMC will conclude its two day monetary policy meeting today and will announce the decision at 18:00 GMT, which will follow press conference from FED chair Janet Yellen at 18:30 GMT. It has become extremely difficult to...

- Market Data