How does inflation influence U.K. and U.S. monetary policy?

Aug 19, 2015 12:14 pm UTC| Insights & Views

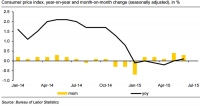

US CPI and the FOMC Minutes are the main macro highlights heading into NY Session today. Will US CPI data for July due later in the day support USD, just like the upside surprise in UK inflation propped up the pound...

Aug 19, 2015 11:40 am UTC| Insights & Views

In the ATM volatility nutshell, the higher side volatility of EURUSD ATM contracts for next 3 months is projected. Although trend is puzzling on either sides the bearish momentum is likely to hold on. Huge volatility is...

Aug 19, 2015 11:36 am UTC| Insights & Views

Todays release of Consumer price index (CPI) numbers will be most watched by traders and investors. CPI is scheduled to be released at 12:30 GMT. Why important? FEDs dual mandate is price stability and maximum...

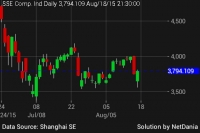

Chinese equities – playing the intervention game

Aug 19, 2015 11:16 am UTC| Insights & Views

Chinas benchmark stock index, Shanghai Composite after yesterdays -6.15% drop, opened down -3% today and recovered sharply to close 1.23% higher, suggesting official intervention at play here In search of official buyers...

After conquering US, shale fracking moves to conquer UK

Aug 19, 2015 10:39 am UTC| Insights & Views

Method known to extract oil and gas from shale layers trapped deep underground is known as fracking, morespecifically hydraulic fracking. The process uses water mixed with chemicals to rupture the shale layers so it can be...

Guide to today’s important data and events

Aug 19, 2015 09:41 am UTC| Insights & Views

Not many economic dockets scheduled for today, focus is on CPI data from US. Data released so far - Australia - Westpac leading index failed to grow again in July after no growth in June. Japan - All...

Delta convention of OECD economies considering option smiles

Aug 19, 2015 08:25 am UTC| Insights & Views

This concept generally arises when forward hedging takes place as these are popular to arrest rate risks, Forward delta conventions are normally used to specify implied volatilities because of the symmetry of put and call...

- Market Data