Risk aversion hits market hard

Jun 09, 2015 12:44 pm UTC| Insights & Views

Two themes of risk aversion is hurting the market hard as billions are being wiped out as stocks and indices move downwards. Risk aversion has hit the market this week as Greece delayed IMF payment, raising the stake in...

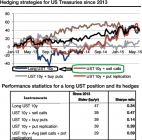

Hedge US treasury bonds shorting on OTM calls

Jun 09, 2015 12:10 pm UTC| Insights & Views

Short USD 6M 10y receivers call, 50 bps out of the money options on bonds, or equivalently.Sell receivers swaption on rates an option seller is naturally short volatility.But in a bear market when prices are declining...

While FED prepares rate hike, inflation expectations remain subdued

Jun 09, 2015 11:26 am UTC| Insights & Views

Fridays jobs report might have given FED hawks some ammunition to fight off the doves and consider rate hike as early as September this year. Despite so market based measure of inflation expectations show that...

Do you think systematic hedging US treasury is unattainable?

Jun 09, 2015 10:50 am UTC| Insights & Views

We all know complete hedging comes with the cost in its entirety. But do you think the advantages of the hedging more priceless than its cost? Or is hedging treasury securities a risky venture?Such type of idiosyncratic...

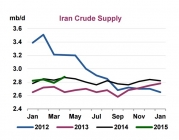

Iran prepares to reenter market

Jun 09, 2015 10:47 am UTC| Insights & Views

Biggest question circulating in the oil market is how Irans presence might impact the market. In June 5 meeting OPEC members kept production target unchanged at 30 million barrels/day. Though the level is already high...

Dollar seems sturdy versus Asian baskets

Jun 09, 2015 10:12 am UTC| Insights & Views

Weve already flagged the fall through export sector and how this will bolster efforts by Asian policymakers to encourage currency weakness through various channels including direct intervention, rate cuts, or more direct...

Asian emerging economies under stress against dollar

Jun 09, 2015 10:07 am UTC| Insights & Views

The Fed cycle could prove particularly stressful for Asian EM this time around if US rates were to rise whilst Asian export growth were contracting as a consequence of the slowdown in China. Asian currencies risk has been...

- Market Data