Jun 09, 2015 09:07 am UTC| Insights & Views

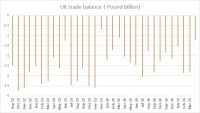

UK trade deficit got reduced significantly in April on the back lower imports of goods, while services exports remained high. Key highlights - The UKs deficit on trade in goods and services was estimated to have been...

Weak Chinese inflation calls for more aggressive action from PBOC

Jun 09, 2015 08:33 am UTC| Insights & Views

Peoples Bank of China (PBOC) since late last year has been providing policy stimulus, however that so far yielded no significant turnaround of weakening Chinese economy. Latest inflation reading showed inflation moved...

Delta hedging on At-The-Money calls of EUR/USD

Jun 09, 2015 08:09 am UTC| Insights & Views

Wholesale inventories in US are expected to increase by 0.4% MoM in April from 0.1% in March.The main event this week though is the release of retail activity on Thursday.The Fed will be in a lockout period most of this...

Jun 09, 2015 08:01 am UTC| Insights & Views

Primary goal of Swiss National Banks (SNB) monetary policy is to maintain price stability, however evidence indicate that SNB is failing its goal for consecutive years putting serious doubts on SNBs credibility as well as...

European Bond’s uproar seems to matter much on derivatives markets

Jun 09, 2015 07:19 am UTC| Insights & Views

How much would you think that rate and FX liquidity worsen as the bond market sell-off extends?The huge European bond selloff in 2015 so far that has already wiped out $300 billion from the market, according to options...

Guide to today’s important data and events

Jun 09, 2015 06:59 am UTC| Insights & Views

Lot of economic releases today with moderate risk associated. Focus is on Euro zone GDP and inflation hearing UK. Data released so far - China - Consumer price index fell by -0.2% m/m, still grew by 1.2% from a year...

Put spreads have become ITM, prolong current position as USD/CAD likely to slide further

Jun 09, 2015 06:25 am UTC| Insights & Views

BoC Senior Deputy Governor Wilkins stuck to broad financial stability and regulatory issues in her remarks at the Montreal conference of the International Economic Forum of the Americas. That didnt offer much for markets,...

- Market Data