FxWirePro: WTI/Brent Crude’s Directional Hedging Strategy

Feb 01, 2019 12:45 pm UTC| Research & Analysis Insights & Views

WTI crude has shown considerable price spikes, a tad below 19% (18.90% to be precise). As you could observe WTI has been attempting to consolidate but bearish risks are still prevalent (refer above price chart). The recent...

FxWirePro: Options for Crypto-options trading

Feb 01, 2019 12:26 pm UTC| Research & Analysis Digital Currency Insights & Views

Cryptocurrency derivatives have been the talk of the town in the recent past, though there has been a mixed bag of performance.Cryptocurrency derivatives, including cryptocurrency futures, cryptocurrency CFDs, and...

Feb 01, 2019 09:36 am UTC| Research & Analysis Technicals

Technical Glance:OnWTI crude daily chart, the bullish engulfing pattern has been traced at $46.57 levels, consequently, the recent rallies have bounced above 7DMAs but were restrained below stiff resistance of $54.84...

Feb 01, 2019 08:12 am UTC| Research & Analysis

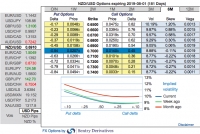

Bearish NZDUSD scenarios below 0.60 if: 1) The NZ housing market slowdown becomes disorderly; 2)The NZ immigration rolls over more quickly; 3) Weaker business confidence sees firms dramatically cut...

A Glimpse at Trending Tokenization – Characteristics of exchange/security/utility tokens

Feb 01, 2019 07:25 am UTC| Research & Analysis Digital Currency Insights & Views

Despite the downturn of the cryptocurrencies that is observed in the past year, may have caused apprehensions for aspirant cryptocurrency investor, we kept reiterating that the buzz world, tokenization mechanism is quite...

FxWirePro: AUDNZD Options Trade Perspectives

Jan 31, 2019 14:38 pm UTC| Research & Analysis Technicals

AUDNZD Strangle Shorts:As you could observe the swings in the major trend have been oscillating between 1.1423 and 1.0333 levels since June 2015, it is wise to deploy (0.5%) out-of-the-money call and (0.5%)...

FxWirePro: No Change in Fed’s approach and no change shorts in Loonie – Uphold CAD RV trades

Jan 31, 2019 11:40 am UTC| Research & Analysis Central Banks

The US Federal Reserve kept the Fed funds rate on hold (at 2.50%), as widely anticipated,it continue toadaptto a more dovish stance than expected, moving to a neutral stance in regards to interest rate adjustments,...

- Market Data