Jan 31, 2019 10:13 am UTC| Research & Analysis Central Banks Insights & Views

A slight loss of NZ economic momentum over the next quarter and more neutral speculator positioning (from extremely short) should weigh on the NZD. Key, though, will be the behavior of the US dollar. if the Fed hikes twice...

FxWirePro: Brexit fatigue still detrimental to Sterling, GBP OTC hedging functions substantiate

Jan 31, 2019 09:42 am UTC| Research & Analysis

Where does one begin in summarizing the Brexit drama in the six weeks or? The low-vol attrition in the GBP spot rate over this period (NEER down 1.5%) might indicate that the range of developments have been detrimental to...

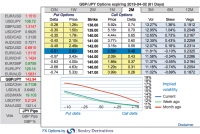

FxWirePro: GBP/JPY Scenarios Analysis, OTC Updates and Options Strategy

Jan 31, 2019 08:46 am UTC| Research & Analysis

Bearish GBPJPY Scenarios: 1) A no-deal Brexit (GBP down between 10-20%). 2) PM May resigns and is replaced by a harder-Brexiteer following the defeat of a Brexit motion in parliament, opening the way to no-deal...

XRP/USD outpaces other crypto-peers on mounting Ripple’s popularity

Jan 31, 2019 07:30 am UTC| Research & Analysis Digital Currency Technicals Insights & Views

The cryptocurrency prices, so far this week, have been attempting to show slight recovery despite major trend being edgy with selling pressures. WithBTCUSDscurrent price (at Bitfinex), $3,550 levels, a jump of about...

Lingering Concerns of “Liquidity”, The Prime Factor Amid Cryptocurrency Bearish Streaks

Jan 30, 2019 13:45 pm UTC| Research & Analysis Digital Currency Insights & Views Commentary

The cryptocurrency prices, so far this week, has been edgy but continued selling pressures.BTCUSD(at Bitfinex), $3,597.90 levels to the recent lows of $3,422 levels. Whereas Ripple (XRP) has attempted to bounce back from...

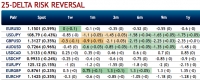

FxWirepro: G10 FX derivatives scanner ahead of FOMC

Jan 30, 2019 13:09 pm UTC| Research & Analysis Central Banks

The main event today is the US Feds monetary policy meeting tonight. We expect rates to remain unchanged at 2.50% and the message from the Fed to remain the same (i.e. it can afford to be patient). The FOMC will hold a...

Jan 30, 2019 12:29 pm UTC| Research & Analysis

We could foresee euros bearish scenarios on following driving forces: 1) Euro area growth is stuck below 2% and ECB hikes only in 2020; 2) The prolonged political dissents and apprehensions in France, a populist tide...

- Market Data