Moody's: Hong Kong banks face rising private sector debt and high property prices; outlook negative

Jul 27, 2017 03:41 am UTC| Research & Analysis

Moodys Investors Service says material imbalances in Hong Kongs (Aa2 stable) economy, including accommodative monetary conditions, rising corporate and household debt, and inflated property prices are weighing on banks...

Moody's changes outlook for China's banking system to stable from negative

Jul 27, 2017 03:12 am UTC| Research & Analysis

Moodys Investors Service has revised its outlook for Chinas banking system to stable from negative. The revision reflects our expectations that nonperforming loan formation rates will be relatively stable at current...

Jul 26, 2017 12:26 pm UTC| Research & Analysis Insights & Views

Bearish GBP scenarios are driven by: 1) Growth slows below 1% as consumers are squeezed by inflation and falling house prices. 2) Outright capital repatriation from slower moving long-term investors including...

Jul 26, 2017 11:33 am UTC| Central Banks Research & Analysis Insights & Views

Brazilian central bank is lined up to announce its monetary policy today, following its last rate meeting in late May the Brazilian central bank had signaled that future rate hikes might happen in smaller steps. This more...

FxWirePro: Snippets of EMEA, EM Asia FX and LatAm FX space

Jul 26, 2017 09:34 am UTC| Research & Analysis Insights & Views

Achieve more value in owning carry than shorting vols in EM: The paucity of opportunities to play vol compression is a boon for carry-friendly option bets in anticipation of a risk rally next week in the absence of an...

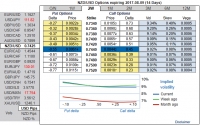

FxWirePro: NZD/USD “Diagonal Credit Put Spreads” to address both bullish and bearish scenarios

Jul 26, 2017 08:20 am UTC| Research & Analysis Insights & Views

In bullish scenarios, we foresee NZDUSD to go towards 0.75 if: 1) The dairy sectors recovery accelerates, reining in the current account deficit; or 2) The migration flows and housing kick up another gear. In...

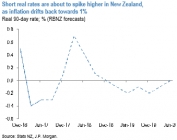

FxWirePro: Currency swap yields on RBNZ and FOMC regime

Jul 26, 2017 07:39 am UTC| Central Banks Research & Analysis Insights & Views

The US 10yr Treasury yields rose from 2.25% to 2.33%, and 2yr yields rose from 1.36% to 1.39%. Fed fund futures yields firmed slightly, pricing the chance of a December rate hike at around 47%. Ahead of todays FOMCs...

- Market Data