Jul 31, 2017 10:00 am UTC| Insights & Views Research & Analysis

Crude oil price is surging but we reckon no certain clarity on major trend which has been downtrend but has gone into consolidation phase from February 2016. U.S. West Texas Intermediate (WTI) futures after briefly...

Jul 31, 2017 09:42 am UTC| Research & Analysis

Theres a bit of a Northern European thing going on at the top of the FX rankings this week. The SEK takes the top place, from a distance, mostly on the back of strong Q2 GDP data released on Friday. Swedish growth...

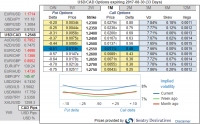

FxWirePro: Macro outlooks, forecasts and options trading perspectives of AUD/JPY

Jul 31, 2017 07:53 am UTC| Research & Analysis Insights & Views

Australian Macro Outlook: June private sector credit is expected to have risen 0.4%, with housing lending up 0.6% but business credit just 0.2%. Chinese PMIs have been steady that is a good sign for Aussie...

FxWirePro: A glance through bullion futures and ETP holdings over FOMC statements and commentaries

Jul 28, 2017 13:23 pm UTC| Research & Analysis Insights & Views

Futures: On the Comex division of the NYMEX,gold futures for August delivery were little changed at $1,259.28, off the previous sessions six-week high of 1,265.00. While the language tweak in the Feds statement hasnt...

FxWirePro: Stay short Dec’17 LME copper but longs for swing traders

Jul 28, 2017 11:25 am UTC| Research & Analysis Insights & Views

The copper prices surged today extending yesterdays gains taking the bull swings to the highest in more than two years on expectations of strong economic growth in China and news of Chinese restrictions on scrap imports...

FxWirePro: Outpaced gamma in dollar’s bearish phase amid global central banks’ gyrations

Jul 28, 2017 11:23 am UTC| Research & Analysis Insights & Views Central Banks

After the dovish Fed statement, the greenback staged a surprise recovery yesterday, which was not necessarily backed by a visible improvement in fundamentals. We think that the pullback will be short-lived, especially...

Jul 28, 2017 10:21 am UTC| Research & Analysis Insights & Views

The bearish USDCAD scenarios (below 1.28) driven by: BoC indicates the intention to normalize rates earlier due to an improved global outlook. Global demand pushes oil prices to $50 plus and towards $60. The...

- Market Data